Cost of electricity by source

Different methods of electricity generation can incur a variety of different costs, which can be divided into three general categories: 1) wholesale costs, or all costs paid by utilities associated with acquiring and distributing electricity to consumers, 2) retail costs paid by consumers, and 3) external costs, or externalities, imposed on society.

Wholesale costs include initial capital, operations & maintenance (O&M), transmission, and costs of decommissioning. Depending on the local regulatory environment, some or all wholesale costs may be passed through to consumers. These are costs per unit of energy, typically represented as dollars/megawatt hour (wholesale). The calculations also assist governments in making decisions regarding energy policy.

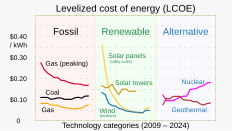

On average the levelized cost of electricity from utility scale solar power and onshore wind power is less than from coal and gas-fired power stations,[1]: TS-25 but this varies greatly by location.[2]: 6–65

Cost metrics

[edit]Levelized cost of energy (LCOE) is a measure of the average net present cost of electricity generation for a generating plant over its lifetime.

Levelized cost of electricity

[edit]The levelized cost of electricity (LCOE) is a metric that attempts to compare the costs of different methods of electricity generation consistently. Though LCOE is often presented as the minimum constant price at which electricity must be sold to break even over the lifetime of the project, such a cost analysis requires assumptions about the value of various non-financial costs (environmental impacts, local availability, others), and is therefore controversial. Roughly calculated, LCOE is the net present value of all costs over the lifetime of the asset divided by an appropriately discounted total of the energy output from the asset over that lifetime.[9]

Levelized cost of storage

[edit]The levelized cost of storage (LCOS) is analogous to LCOE, but applied to energy storage technologies such as batteries.[10] Regardless of technology, however, storage is but a secondary source of electricity dependent on a primary source of generation. Thus, a true cost accounting demands that the costs of both primary and secondary sources be included when the cost of storage is compared to the cost of generating electricity in real time to meet demand.[citation needed]

A cost factor unique to storage are losses that occur due to inherent inefficiencies of storing electricity, as well as increased CO2 emissions if any component of the primary source is less than 100% carbon-free.[11] In the U.S., a comprehensive 2015 study found that net system CO2 emissions resulting from storage operation are nontrivial when compared to the emissions from electricity generation [in real time to meet demand], ranging from 104 to 407 kg/MWh of delivered energy depending on location, storage operation mode, and assumptions regarding carbon intensity.[11]

Levelized avoided cost of electricity

[edit]The metric levelized avoided cost of energy (LACE) addresses some of the shortcomings of LCOE by considering the economic value that the source provides to the grid. The economic value takes into account the dispatchability of a resource, as well as the existing energy mix in a region.[12]

In 2014, the US Energy Information Administration recommended[13] that levelized costs of non-dispatchable sources such as wind or solar be compared to the "levelized avoided cost of energy" (LACE) rather than to the LCOE of dispatchable sources such as fossil fuels or geothermal. LACE is the avoided costs from other sources divided by the annual yearly output of the non-dispatchable source.[example needed] The EIA hypothesized that fluctuating power sources might not avoid capital and maintenance costs of backup dispatchable sources. The ratio of LACE to LCOE is referred to as the value-cost ratio. When LACE (value) is greater than LCOE (cost), then value-cost ratio is greater than 1, and the project is considered economically feasible.[14]

Value-adjusted levelized cost of electricity

[edit]The value-adjusted levelized cost of electricity (VALCOE) is a metric devised by the International Energy Agency which includes both the cost of the electricity and the value to the electricity system.[15] For example, the same amount of electricity is more valuable at a time of peak demand.

Capture rate

[edit]The capture rate is the volume-weighted average market price (or capture price) that a source receives divided by the time-weighted average price for electricity over a period.[16][17][18][19] For example, a dammed hydro plant might only generate when prices are high and so have a capture rate of 200%, whereas a source that is not dispatchable, such as a wind farm without batteries, would typically have a capture rate under 100%.[19] Typically the more of a single type of renewable that is built in a pricing area (such as Great Britain) the lower the capture rate will become for that type, for example if many wind farms generate a lot at the same time the price at that time will go down.[16] There can be curtailment if grid connectivity is lacking across the pricing area – for example from wind power in Scotland to consumers in England – resulting in the capture rate not reflecting the true cost.[16]

Cost factors

[edit]While calculating costs, several internal cost factors have to be considered.[20] Note the use of "costs," which is not the actual selling price, since this can be affected by a variety of factors such as subsidies and taxes:

- Capital costs tend to be low for gas and oil power stations; moderate for onshore wind turbines and solar PV (photovoltaics); higher for coal plants and higher still for waste-to-energy, wave and tidal, solar thermal, offshore wind and nuclear.

- Fuel costs – high for fossil fuel and biomass sources, low for nuclear, and zero for many renewables. Fuel costs can vary somewhat unpredictably over the life of the generating equipment, due to political and other factors.

To evaluate the total cost of production of electricity, the streams of costs are converted to a net present value using the time value of money. These costs are all brought together using discounted cash flow.[21][22]

Capital costs

[edit]For power generation capacity capital costs are often expressed as overnight cost per kilowatt. Estimated costs are:

| Type | US EIA[23] | US NREL[24] | $/MWh[24] | CF[24] |

|---|---|---|---|---|

| Coal power | $4,074 | $3,075–5,542 | ||

| Coal with 90% carbon capture | $6,495–6,625 | |||

| Natural gas | $922–2,630 | |||

| Combined-cycle | $1,062–1,201 | |||

| Combined-cycle with 90% carbon capture | $2,736–2,845 | |||

| Internal combustion engine | $2,018 | |||

| Turbine, aeroderivative | $1,294 | |||

| Turbine, industrial | $785 | |||

| Nuclear | $6,695–7,547 | $7,442–7,989 | $81–82 | 94% |

| Wind power | $1,718 | $1,462 | $27–75 | 18–48% |

| Wind, offshore | $4,833–6,041 | $3,285–5,908 | $67–146 | 29–52% |

| Distributed generation (wind) | $1,731–2,079 | $2,275–5,803 | $32–219 | 11–52% |

| Solar thermal/concentrated | $7,895 | $6,505 | $76–97 | 49–63% |

| Solar photovoltaic | $1,327 | $1,333–2,743 | $31–146 | 12–30% |

| Solar PV with storage | $1,748 | $2,044 | $53–81 | 20–31% |

| Battery storage | $1,316 | $988–4,774 | 8–42% | |

| Fuel cells | $6,639–7,224 | |||

| Pumped-storage hydroelectricity | $1,999–5,505 | |||

| Hydropower, conventional | $3,083 | $2,574–16,283 | $60–366 | 31–66% |

| Biomass | $4,524 | $4,416 | $144 | 64% |

| Geothermal power | $3,076 | $6,753–46,223 | $55–396 | 80–90% |

Real life costs can diverge significantly from those estimates. Olkiluoto block 3, which achieved first criticality in late 2021 had an overnight cost to the construction consortium (the utility paid a fixed price agreed to when the deal was signed of only 3.2 billion euros) of €8.5 billion and a net electricity capacity of 1.6 GW or €5310 per kW of capacity.[25] Meanwhile Darlington Nuclear Generating Station in Canada had an overnight cost of CA$5.117 billion for a net electric capacity of 3512 MW or CA$1,457 per kW of capacity.[26] The oft cited figure of CA$14.319 billion – which works out to CA$4,077 per kW of capacity – includes interest (a particularly high cost in this case as the utility had to borrow at market rates and had to absorb the cost of delays in construction) and is thus not an "overnight cost". Furthermore, there is the issue of comparability of different sources of power, as capacity factors can be as low as 10–20% for some wind and solar applications reaching into the 50% range for offshore wind and finally above 90% for the most reliable nuclear power plants.[27] The average capacity factor of all commercial nuclear power plants in the world in 2020 was 80.3% (83.1% the prior year) but this includes outdated Generation II nuclear power plants and countries like France which run their nuclear power plants load following which reduces the capacity factor.[28] Peaking power plants have particularly low capacity factors but make up for it by selling electricity at the highest possible price when supply does not meet demand otherwise.[29]

The first German Offshore Wind Park Alpha Ventus Offshore Wind Farm with a nameplate capacity of 60 MW cost €250 million (after an initial estimate of €190 million).[30] In 2012, it produced 268 GWh of electricity, achieving a capacity factor of just over 50%.[31] If the overnight cost is calculated for the nameplate capacity, it works out to €4167 per kW whereas if one takes into account the capacity factor, the figure needs to be roughly doubled.

Geothermal power is unique among renewables in that it usually has a low above-ground impact and is capable of baseload power generation as well as combined heat and power. However, depending on the plant and conditions underground naturally occurring radioactive materials such as radon may be released into the air.[32] This partially offsets relatively high costs per capacity which were cited as US$200 million for the 45 MW first phase of Þeistareykir Geothermal Power Station and a total of US$330 million for the 90 MW combined two first phases. This gives a cost per kW of capacity of US$4,444 if only the first phase is considered and US$3,667 if the cost estimates for both phases together hold.[33] The source also calls this power plant uniquely cost effective for geothermal power and the unique geology of Iceland makes the country one of the largest producers of geothermal power worldwide and by far the largest per capita or relative to all energy consumed.

Block 5 of Irsching Power Station in Southern Germany uses natural gas as fuel in a combined cycle converting 1750 megawatts of thermal energy to 847 net MW of usable electricity. It cost €450 million to build.[34] This works out to some €531 per kW of capacity. However, due to the uneconomical prospect of operating it as a peaking power plant, the owners, soon after opening the plant in 2010, wanted to shut down the plant.[35]

The LCOE of floating wind power increases with the distance from shore.[36]

The Lieberose Photovoltaic Park – one of the largest in Germany – had a nameplate capacity at opening of 52.79 megawatt and cost some €160 million to build[37][38] or €3031 per kW. With a yearly output of some 52 GWh (equivalent to just over 5.9 MW) it has a capacity factor just over 11%. The €160 million figure was again cited when the solar park was sold in 2010.[39]

The world's largest solar farm to date (2022) in Rajasthan, India – Bhadla Solar Park – has a total nameplate capacity of 2255 MW and cost a total of 98.5 billion Indian rupees to build.[40] This works out to roughly 43681 rupees (€480) per kW.

As can be seen by these numbers, costs vary wildly even for the same source of electricity from place to place or time to time and depending on whether interest is included in total cost. Furthermore, capacity factors and the intermittency of certain power sources further complicate calculations. Another issue that is often omitted in discussions is the lifespan of various power plants – some of the oldest hydropower plants have existed for over a century, and nuclear power plants going on five or six decades of continuous operation are no rarity. However, many wind turbines of the first generation have already been torn down as they can no longer compete with more modern wind turbines and/or no longer fit into the current regulatory environment.[citation needed] Some of them were not even twenty-five years old. Solar panels exhibit a certain aging, which limits their useful lifetime, but real world data does not yet exist for the expected lifetime of the latest models.

Operations and maintenance (O&M) costs

[edit]O&M costs include marginal costs of fuel, maintenance, operation, waste storage, and decommissioning for an electricity generation facility. Fuel costs tend to be highest for oil fired generation, followed in order by coal, gas, biomass and uranium. Due to the high energy density of uranium (or MOX fuel in plants that use this alternative to uranium) and the comparatively low price on the world uranium market (especially when measured in units of currency per unit of energy content), fuel costs only make up a fraction of the operating costs of nuclear power plants. In general, the cost balance between capital and running costs tilts in favor of lower operating expenses for renewables and nuclear and in the other direction for fossil fuels.

As sovereign debt in high income countries is usually to be had at lower interest rates than private loans, nuclear and renewable power become significantly cheaper – also compared to fossil alternatives – the bigger the involvement of state investment or state guarantees. In the Global South, where interest rates tend to be higher, the shorter construction period of small scale projects (particularly wind and solar) partially compensates for their increased capital cost. In terms of import substitution, solar can be particularly attractive in replacing bunker oil or diesel generators for rural electrification as it needs no imported hydrocarbons and as it allows hydrocarbon resources (where available) to be exported instead.[41][42]

Short-term fluctuations in fuel prices can have significant effects on the cost of energy generation in natural gas and oil fired power plants and to a lesser extent for coal fired power plants. As renewable energies need no fuel, their costs are independent of world markets for fuels once built. Coal-fired power plants are often supplied with locally or at least domestically available coal – this is especially true for lignite whose low grade and high moisture content make transporting it over long distances uneconomical – and are thus less subject to the influence of world markets. If there is a carbon tax or other forms of CO2-pricing, this can have a significant impact on the economic viability of fossil fueled power plants. Due to the ease of stockpiling uranium and the rarity of refueling (most Pressurized Water Reactors will change about a quarter to a third of their fuel loading every one and a half to two years[43][44]), short term fluctuations in world uranium prices are a risk absorbed by fuel suppliers, not power plant operators. However, long-term trends in uranium price can have an effect of a few tenths of a cent to a cent or two per kilowatt-hour on the final price of nuclear energy.[45]

The biggest factor in the operating costs of both nuclear and renewable are local wages – in most cases those need to be paid regardless of whether the plant is operating at full capacity or putting out only a fraction of its nameplate capacity and thus those plants are usually run to as high a fraction of their capacity as the market (negative prices) and weather (avoiding overheating rivers with cooling water, availability of sun or wind...) allow.[46][47] However, in France the nuclear power plants which provide some 70% of electricity demand are run load following to stabilize the grid. As a lot of home heating in France is supplied via electric means (heat pumps and resistive heating), there is a notable seasonality to nuclear energy generation in France with planned outages usually scheduled for the lower demand summer period, which also coincides with school holidays in France. In Germany some two decades old and older wind turbines were shut down after no longer receiving renewable energy subsidies due to a reported market-rate electricity price of some €0.03 per kWh not covering marginal costs or only covering them as long as no major maintenance was needed.[48] By contrast after being fully depreciated, Germany's (then remaining) nuclear power plants were described in media reports throughout the 2010s and into the early 2020s as highly profitable for their operators even without direct government subsidy.[49][50][51]

Market matching costs

[edit]Many scholars, such as Paul Joskow, have described limits to the "levelized cost of electricity" metric for comparing new generating sources. In particular, LCOE ignores time effects associated with matching production to demand. This happens at two levels:

- Dispatchability, the ability of a generating system to come online, go offline, or ramp up or down, quickly as demand swings.

- The extent to which the availability profile matches or conflicts with the market demand profile.

Ramp rates (how fast the power can be increased or decreased) may be quicker for more modern nuclear and the economics of nuclear power plants differ.[52][53] Nevertheless, capital intensive technologies such as wind, solar, and nuclear are economically disadvantaged unless generating at maximum availability since the LCOE is nearly all sunk-cost capital investment. Grids with very large amounts of intermittent power sources, such as wind and solar, may incur extra costs associated with needing to have storage or backup generation available.[54] At the same time, intermittent sources can be even more competitive if they are available to produce when demand and prices are highest, such as solar during summertime mid-day peaks seen in hot countries where air conditioning is a major consumer.[55]

Another limitation of the LCOE metric is the influence of energy efficiency and conservation (EEC).[56][better source needed] In the 2010s EEC caused the electricity demand of many countries, such as the US,[57] to remain flat or decline.[58][59] For solar systems installed at the point of end use, it may be more economical to invest in EEC first, then solar, or both at the same time.[60] This results in a smaller required solar system than what would be needed without the EEC measures. However, designing a solar system on the basis of LCOE would cause the smaller system LCOE to increase, as the energy generation drops faster than the system cost.[clarification needed] The whole of system life cycle cost should be considered, not just the LCOE of the energy source.[56] LCOE is not as relevant to end-users than other financial considerations such as income, cashflow, mortgage, leases, rent, and electricity bills.[56] Comparing solar investments in relation to these can make it easier for end-users to make a decision, or using cost-benefit calculations "and/or an asset's capacity value or contribution to peak on a system or circuit level".[56]

External costs of energy sources

[edit]Typically pricing of electricity from various energy sources may not include all external costs – that is, the costs indirectly borne by society as a whole as a consequence of using that energy source.[61] These may include enabling costs, environmental impacts, energy storage, recycling costs, or beyond-insurance accident effects.

Solar panel performance is usually guaranteed for 25 years and sometimes 30.[62] According to a 2021 Harvard Business Review study costs of recycling solar panels will reach $20–30 per panel in 2035, which would increase the LCOE fourfold for PV solar power but only if panels are replaced after 15 years rather than the expected 30 years. If panels are replaced early this presents a significant policy challenge because if the recycling is made legal duty of the manufacturers (as it already is in the EU) it will dramatically reduce profit margins on this already competitive market.[63] A 2021 IEA study of repairing old panels to reuse rather than recycle them concluded that the financial viability depends on country specific factors such as grid tariffs, but that reuse is only likely for utility solar, as rooftop owners will want to make best use of space with more efficient new panels.[64]

An EU funded research study known as ExternE, or Externalities of Energy, undertaken over the period of 1995 to 2005 found that the cost of producing electricity from coal or oil would double over its present value, and the cost of electricity production from gas would increase by 30% if external costs such as damage to the environment and to human health, from the particulate matter, nitrogen oxides, chromium VI, river water alkalinity, mercury poisoning and arsenic emissions produced by these sources, were taken into account. It was estimated in the study that these external, downstream, fossil fuel costs amount up to 1–2% of the EU's entire Gross Domestic Product (GDP), and this was before the external cost of global warming from these sources was even included.[65][66] Coal has the highest external cost in the EU, and global warming is the largest part of that cost.[61] Sustainable energy avoids or greatly reduces future costs to society, such as respiratory illnesses.[67][68] In 2022 the EU created a green taxonomy to indicate which energy investments reduce such external costs.

A means to address a part of the external costs of fossil fuel generation is carbon pricing — the method most favored by economists for reducing global-warming emissions.[69] Carbon pricing charges those who emit carbon dioxide for their emissions. That charge, called a "carbon price", is the amount that must be paid for the right to emit one tonne of carbon dioxide into the atmosphere. Carbon pricing usually takes the form of a carbon tax or a requirement to purchase permits to emit (also called "allowances").

Depending on the assumptions of possible accidents and their probabilities external costs for nuclear power vary significantly and can reach between 0.2 and 200 ct/kWh.[70] Furthermore, nuclear power is working under an insurance framework that limits or structures accident liabilities in accordance with the Paris convention on nuclear third-party liability, the Brussels supplementary convention, and the Vienna convention on civil liability for nuclear damage[71] and in the U.S. the Price-Anderson Act. It is often argued that this potential shortfall in liability represents an external cost not included in the cost of nuclear electricity; but the cost is small, amounting to about 0.1% of the levelized cost of electricity, according to a 2008 study.[72]

These beyond-insurance costs for worst-case scenarios are not unique to nuclear power, as hydroelectric power plants are similarly not fully insured against catastrophic events like a large dam failure. As private insurers base dam insurance premiums on limited scenarios, major disaster insurance in this sector is likewise provided by the state.[73][better source needed]

Because externalities are diffuse in their effect, external costs cannot be measured directly, but must be estimated.

International trade

[edit]Different countries charge generating companies differently for the negative externalities (such as pollution) that they create. To avoid unfair competition from imports of dirty electricity a tariff may be applied. For example, the UK and the EU may include electricity in their Carbon Border Adjustment Mechanisms.[74] Alternatively the emissions trading systems (ETS) of the importing and exporting countries may be linked,[75] or the generators in one country may be subject to the ETS of another country (for example Northern İreland generators are in the EU ETS).[76]

Additional cost factors

[edit]Calculations often do not include wider system costs associated with each type of plant, such as long-distance transmission connections to grids, or balancing and reserve costs. Calculations do not necessarily include externalities such as health damage by coal plants, nor the effect of greenhouse emissions on the climate change, ocean acidification and eutrophication, ocean current shifts. Decommissioning costs of power plants are usually not included (nuclear power plants in the United States is an exception, because the cost of decommissioning is included in the price of electricity per the Nuclear Waste Policy Act), is therefore not full cost accounting. These types of items can be explicitly added as necessary depending on the purpose of the calculation.

Other non-financial factors may include:

- Comparisons of life-cycle greenhouse gas emissions show coal, for instance, to be radically higher in terms of GHGs than any alternative.

- Surface power density measures power per unit surface area using given technology, and can vary by several orders of magnitude between high- and low-density sources. Surface power density is a significant limiting factor in countries with high population density.

- Impacts on wildlife include an estimated 888,000 bats killed annually by collision with U.S. wind turbines.[77] Millions of birds are estimated to be killed or electrocuted each year by collision with high-voltage power lines and pylons,[78] and millions more by fossil fuel power plants.[79]

- Other environmental concerns with electricity generation include acid rain, ocean acidification and effect of coal extraction on watersheds.

- Various human health concerns with electricity generation, including asthma and smog, now dominate decisions in developed nations that incur health care costs publicly.[clarification needed] A 2021 study estimated the health costs of coal power at hundreds of billions of dollars for the rest of the decade.[80]

Global studies

[edit]Graphs are unavailable due to technical issues. There is more info on Phabricator and on MediaWiki.org. |

| IPCC 2014[81] (at 5% discount rate) | IRENA 2020[82] | Lazard 2023[83] | NEA 2020[84] (at 7% discount rate) | BNEF 2021[85] | |

|---|---|---|---|---|---|

| PV (utility, fixed-axis) | 110 | 68 | 24–96 | 56 | 39 |

| PV (utility, tracking) | - | - | - | - | 47 |

| PV (residential) | 150 | 164 | 117–282 | 126 | - |

| Solar (thermal) | 150 | 182 | - | 121 | - |

| Wind, onshore | 59 | 53 | 24–75 | 50 | 41 |

| Wind, offshore | 120 | 115 | 72–140 | 88 | 79 |

| Nuclear new (existing) | 65 | - | 141–221* (31) | 69 (32) | - |

| Hydro | 22 | 47 | - | 68 | - |

| Geothermal | 60 | 73 | 61-102 | 99 | - |

| Coal (CC) | 61 | - | 68–166 | 88 (110) | - |

| Gas CC (Peak) | 71 | - | 115–221 | 71 | - |

*LCOE estimates for nuclear power from Lazard are "based on the then-estimated costs of the Vogtle Plant and US-focused".[83]

Bank of America (2023)

[edit]In 2023, Bank of America conducted a LCOE study in which it postulated that existing LCOE estimates for renewables do not account for fossil fuel or battery backup and therefore levelized full system cost of electricity (LFSCOE)[86] would be a more reasonable metric to compare sources in terms of providing 24/7 consumer electricity.[87]

| LCOE $/MWh | LFSCOE (Texas, US) $/MWh | LFSCOE (Germany, EU) $/MWh | |

|---|---|---|---|

| Nuclear | 82 | 122 | 106 |

| Wind | 40 | 291 | 504 |

| Solar | 36 | 413 | 1548 |

| Biomass | 95 | 117 | 104 |

| Coal | 76 | 90 | 78 |

| Gas | 38 | 40 | 35 |

BNEF (2021)

[edit]In March 2021, Bloomberg New Energy Finance found that "renewables are the cheapest power option for 71% of global GDP and 85% of global power generation. It is now cheaper to build a new solar or wind farm to meet rising electricity demand or replace a retiring generator, than it is to build a new fossil fuel-fired power plant. ... On a cost basis, wind and solar is the best economic choice in markets where firm generation resources exist and demand is growing."[85]: 24 They further reported "the levelized cost of energy from lithium-ion battery storage systems is competitive with many peak-demand generators."[85]: 23 BNEF does not disclose the detailed methodology and LCOE calculation assumptions, however, apart from declaring it is "derived from selected public sources".[85]: 98 Costs of gas peakers are substantial, and include both the cost of fuel and external costs of its combustion. Costs of its combustion include emission of greenhouse gases carbon monoxide and dioxide, as well as nitrogen oxides (NOx), which damage the human respiratory system and contribute to acid rain.[88]

IEA & OECD NEA (2020)

[edit]In December 2020, IEA and OECD NEA published a joint Projected Costs of Generating Electricity study which looks at a very broad range of electricity generating technologies based on 243 power plants in 24 countries. The primary finding was that "low-carbon generation is overall becoming increasingly cost competitive" and "new nuclear power will remain the dispatchable low-carbon technology with the lowest expected costs in 2025". The report calculated LCOE with assumed 7% discount rate and adjusted for systemic costs of generation.[84] The report also contains a modeling utility that produces LCOE estimates based on user-selected parameters such as discount rate, carbon price, heat price, coal price and gas price.[89] The report's main conclusions:[90]

- LCOE of specific energy sources significantly differs between countries due to their geographic, political and regulatory situation;

- low-carbon energy sources cannot be considered in separation, as they operate in "complex interactions" with each other to ensure reliable supply at all times; IEA analysis captures these interactions in value-adjusted LCOE or VALCOE;

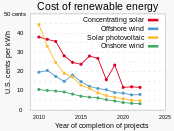

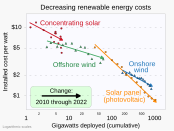

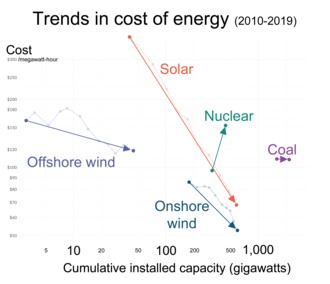

- cost of renewable energy sources significantly decreased and are competitive (in LCOE terms) with dispatchable fossil fuel generation;

- cost of extension of operations of existing nuclear power plants (LTO, long-term operations) has the lowest LCOE of low-carbon energy sources;

Lazard (2020)

[edit]In October 2020, the financial firm Lazard compared renewable and conventional sources of energy, including comparison between existing and new generation (see table). Lazard study assumes "60% debt at 8% interest rate and 40% equity at 12% cost" for its LCOE calculation but did not disclose their methodology or project portfolio used to calculate prices.[91] In the 2023 study Lazard explained their LCOE estimates for nuclear power are "based on the then-estimated costs of the Vogtle Plant and US-focused".[83]

IPCC (2014)

[edit]IPCC Fifth Assessment Report contains LCOE calculations[81] for broad range of energy sources in the following four scenarios:

- 10% WACC, high full load hours (FLH), no carbon tax

- 5% WACC, high FLH, no carbon tax — scenario presented in the above table

- 10% WACC, low FLH, no carbon tax

- 10% WACC, high FLH, $100/tCO2eq carbon tax

Regional studies

[edit]Australia

[edit]BNEF[92] estimated the following costs for electricity generation in Australia:[93]

| Source | Solar | Wind onshore | Gas CC | Wind plus storage | Solar plus storage | Storage (4hr) | Gas peaker |

|---|---|---|---|---|---|---|---|

| Mean $US/MWh | 47 | 58 | 81 | 87 | 118 | 156 | 228 |

Europe

[edit]It can be seen from the following table that the cost of renewable energy, particularly photovoltaics, is falling very rapidly. As of 2017, the cost of electricity generation from photovoltaics, for example, has fallen by almost 75% within 7 years.[94]

| Energy Source | Publication 2009[95] | Publication 2011[96] | Study 2012[97] | Various individual data (as of 2012) | Study 2013[98] | Study 2015[99] | Study 2018[100] | Study 2021[101] |

|---|---|---|---|---|---|---|---|---|

| Nuclear | 50[a] | 60–100 | – | 70–90;[102] 70–100;[103] 105[104] | – | 36–84 | – | – |

| Lignite | 46–65[b] | 45–100[c] | – | – | 38–53 | 29–84 | 45.9–79.8 | 103.8–153.4 |

| Hard Coal | 49–68[b] | 45–100[c] | – | – | 63–80 | 40–116 | 62.7–98.6 | 110.3–200.4 |

| Natural Gas (CCGT) | 57–67[b] | 40–75 | – | 93[104] | 75–98 | 53–168 | 77.8–99.6 | 77.9–130.6 |

| Hydro | – | – | – | – | – | 22–108 | – | – |

| Wind, onshore | 93 | 50–130 | 65–81 | 60.35–111;[105] 118[104] | 45–107 | 29–114 | 39.9–82.3 | 39.4–82.9 |

| Wind, offshore | – | 120–180 | 112–183 | 142–150[104] | 119–194 | 67–169 | 74.9–137.9 | 72.3–121.3 |

| Biogas | – | – | – | 126[104] | 135–215 | – | 101.4–147.4 | 72.2–172.6 |

| Small-scale PV (Germany) | – | – | 137–203 | – | 98–142 | – | 72.3–115.4 | 58.1–80.4 |

| Large-Scale PV | 32 | – | 107–167 | 100;[106] 184[104] | 79–116 | 35–180 | 37.1–84.6 | 31.2–57 |

In the United Kingdom, a feed-in tariff of £92.50/MWh at 2012 prices (currently the equivalent of €131/MWh)[107] plus inflation compensation was set in 2013 for the new nuclear power plant to be built at Hinkley Point C, with a term of 35 years. At that time, this was below the feed-in tariff for large photovoltaic and offshore wind plants and above onshore wind plants.[108][109][110]

In Germany, the bidding processes that have been carried out since 2017 have led to significant cost reductions. In one bid for offshore wind farms, at least one bidder dispensed entirely with public subsidies and was prepared to finance the project through the market alone. The highest subsidy price that was still awarded was 6.00 ct/kWh.[111] In a bid for onshore wind farm projects, an average payment of 5.71 ct/kWh was achieved, and 4.29 ct/kWh in a second bidding round.

In 2019, there were bids for new offshore wind farms in the United Kingdom, with costs as low as 3.96 pence per kWh (4.47 ct).[112]

In the same year, there were bids in Portugal for photovoltaic plants, where the price for the cheapest project is 1.476 ct/kWh.[113]

As of 2022[update], gas is the largest source of electricity at 40%:[114] its cost varies and being high carbon it causes climate change.[115] So to reduce the share of gas the government annually auctions contracts for difference to build low-carbon generation capacity, mainly offshore wind.[116] Before 2022 these generators had always received payments from electricity suppliers, but that year they started making payments.[117] In other words renewables became subsidy free,[118] partly due to the fall in cost of offshore wind.[119] Instead of gas still dark weeks can be supplied by Norwegian hydropower[120] or by nuclear. As many of Britain's existing nuclear reactors are due to retire soon the government hopes that cost effective small modular reactors can be developed.[114]

France

[edit]This section needs to be updated. (March 2022) |

The International Energy Agency and EDF have estimated the following costs. For nuclear power, they include the costs due to new safety investments to upgrade the French nuclear plant after the Fukushima Daiichi nuclear disaster; the cost for those investments is estimated at €4/MWh. Concerning solar power, the estimate of €293/MWh is for a large plant capable of producing in the range of 50–100 GWh/year located in a favorable location (such as in Southern Europe). For a small household plant that can produce around 3 MWh/year, the cost is between 400 and €700/MWh, depending on location. Solar power was by far the most expensive renewable source of electricity among the technologies studied, although increasing efficiency and longer lifespan of photovoltaic panels together with reduced production costs have made this source of energy more competitive since 2011. By 2017, the cost of photovoltaic solar power had decreased to less than €50/MWh.

| Technology | Cost in 2017 |

|---|---|

| Hydro power | |

| Nuclear (with state-covered insurance costs) | 50 |

| Nuclear EPR | 100[121] |

| Natural gas turbines without CO2 capture | |

| Onshore wind | 60[121] |

| Solar farms | 43.24[122] |

Germany

[edit]The Fraunhofer Institute for Solar Energy Systems publishes studies comparing the cost of different styles of energy production. The values for PV installations are based on the average cost between Northern and Southern Germany. The reports differentiate between the two and gives more details.[123]

| 2012 | 2013 | 2018 | 2021 | |

|---|---|---|---|---|

| PV rooftop (small) | 170 | 120 | 93.85 | 84.1 |

| PV rooftop (large) | - | - | - | 72.1 |

| PV ground (utility) | 137 | 97.5 | 52.4 | 44.1 |

| Wind, onshore | 73 | 76 | 61.1 | 61.15 |

| Wind, offshore | 147.5 | 156.5 | 106.4 | 96.8 |

| Biogas | - | 120 | 124.4 | 128.55 |

| Solid Biomass | - | - | - | 112.75 |

| Lignite | - | 45.5 | 62.85 | 128.6 |

| Hard Coal | - | 71.5 | 80.65 | 155.35 |

| CCGT | - | 86.5 | 88.7 | 104,25 |

| Gas Turbine | - | - | 164.85 | 202.1 |

The LCOE for PV battery systems refers to the total amount of energy produced by the PV system minus storage losses. The storage losses are calculated based on the capacity of the battery storage, the assumed number of cycles and the efficiency of the battery. The results include differences in PV costs, battery costs (500 to 1200 EUR/kWh), and varying solar irradiation. For larger rooftop PV systems with battery storage, the battery costs between 600 and 1000 EUR/kWh. For ground-mounted PV with battery storage systems, investment costs for battery storage of 500 to 700 EUR/kWh were assumed. The prices for smaller systems are in part lower, as these are standardized products, whereas larger battery systems tend to be individualized projects that additionally incur costs for project development, project management, and infrastructure. The range of investment costs is smaller for the larger sizes, as there is more competitive pressure.

| 2021 | |

|---|---|

| PV rooftop (small, battery 1:1) | 140.5 |

| PV rooftop (large, battery 2:1) | 104.9 |

| PV ground (utility, battery 3:2) | 75.8 |

Middle East

[edit]The capital investment costs, fixed and variable costs, and the average capacity factor of utility-scale wind and photovoltaic electricity supplies from 2000 to 2018 have been obtained using overall variable renewable electricity production of the countries in the Middle East and 81 examined projects.

| Year | Capacity factor | LCOE ($/MWh) | ||

|---|---|---|---|---|

| Wind | Photovoltaic | Wind | Photovoltaic | |

| 2000 | 0.19 | 0.17 | - | - |

| 2001 | - | 0.17 | - | - |

| 2002 | 0.21 | 0.21 | - | - |

| 2003 | - | 0.17 | - | - |

| 2004 | 0.23 | 0.16 | - | - |

| 2005 | 0.23 | 0.19 | - | - |

| 2006 | 0.20 | 0.15 | - | - |

| 2007 | 0.17 | 0.21 | - | - |

| 2008 | 0.25 | 0.19 | - | - |

| 2009 | 0.18 | 0.16 | - | - |

| 2010 | 0.26 | 0.20 | 107.8 | - |

| 2011 | 0.31 | 0.17 | 76.2 | - |

| 2012 | 0.29 | 0.17 | 72.7 | - |

| 2013 | 0.28 | 0.20 | 72.5 | 212.7 |

| 2014 | 0.29 | 0.20 | 66.3 | 190.5 |

| 2015 | 0.29 | 0.19 | 55.4 | 147.2 |

| 2016 | 0.34 | 0.20 | 52.2 | 110.7 |

| 2017 | 0.34 | 0.21 | 51.5 | 94.2 |

| 2018 | 0.37 | 0.23 | 42.5 | 85.8 |

| 2019 | - | 0.23 | - | 50.1 |

Turkey

[edit]As of March 2021[update] for projects starting generating electricity in Turkey from renewable energy in Turkey in July feed-in-tariffs in lira per kWh are: wind and solar 0.32, hydro 0.4, geothermal 0.54, and various rates for different types of biomass: for all these there is also a bonus of 0.08 per kWh if local components are used.[126] Tariffs will apply for 10 years and the local bonus for 5 years.[126] Rates are determined by the presidency,[127] and the scheme replaces the previous USD-denominated feed-in-tariffs for renewable energy.[128]

Japan

[edit]This section needs to be updated. (July 2016) |

A 2010 study by the Japanese government (pre-Fukushima disaster), called the Energy White Paper,[129] concluded the cost for kilowatt hour was ¥49 for solar, ¥10 to ¥14 for wind, and ¥5 or ¥6 for nuclear power.

Masayoshi Son, an advocate for renewable energy, however, has pointed out that the government estimates for nuclear power did not include the costs for reprocessing the fuel or disaster insurance liability. Son estimated that if these costs were included, the cost of nuclear power was about the same as wind power.[130][131][132]

More recently, the cost of solar in Japan has decreased to between ¥13.1/kWh to ¥21.3/kWh (on average, ¥15.3/kWh, or $0.142/kWh).[133]

The cost of a solar PV module make up the largest part of the total investment costs. As per the recent analysis of Solar Power Generation Costs in Japan 2021, module unit prices fell sharply. In 2018, the average price was close to 60,000 yen/kW, but by 2021 it is estimated at 30,000 yen/kW, so cost is reduced by almost half.

United States

[edit]This section may contain an excessive amount of intricate detail that may interest only a particular audience. (September 2021) |

Energy Information Administration (2020)

[edit]Since 2010, the US Energy Information Administration (EIA) has published the Annual Energy Outlook (AEO), with yearly LCOE projections for future utility-scale facilities to be commissioned in about five years' time.

The following data are from the Energy Information Administration's (EIA) Annual Energy Outlook released in 2020 (AEO2020). They are in dollars per megawatt-hour (2019 USD/MWh). These figures are estimates for plants going into service in 2025, exclusive of tax credits, subsidies, or other incentives.[134] The LCOE below is calculated based on a 30-year recovery period using a real after tax weighted average cost of capital (WACC) of 6.1%. For carbon intensive technologies 3 percentage points are added to the WACC. (This is approximately equivalent to a fee of $15 per metric ton of carbon dioxide CO2.) Federal tax credits and various state and local incentive programs would be expected to reduce some of these LCOE values. For example, EIA expects the federal investment tax credit program to reduce the capacity weighted average LCOE of solar PV built in 2025 by an additional $2.41, to $30.39.

The electricity sources which had the most decrease in estimated costs over the period 2010 to 2019 were solar photovoltaic (down 88%), onshore wind (down 71%) and advanced natural gas combined cycle (down 49%).

For utility-scale generation put into service in 2040, the EIA estimated in 2015 that there would be further reductions in the constant-dollar cost of concentrated solar power (CSP) (down 18%), solar photovoltaic (down 15%), offshore wind (down 11%), and advanced nuclear (down 7%). The cost of onshore wind was expected to rise slightly (up 2%) by 2040, while natural gas combined cycle electricity was expected to increase 9% to 10% over the period.[135]

| Estimate in $/MWh | Coal convent'l | Nat. gas combined cycle | Nuclear advanced | Wind | Solar | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| of year | ref | for year | convent'l | advanced | onshore | offshore | PV | CSP | ||

| 2010 | [136] | 2016 | 100.4 | 83.1 | 79.3 | 119.0 | 149.3 | 191.1 | 396.1 | 256.6 |

| 2011 | [137] | 2016 | 95.1 | 65.1 | 62.2 | 114.0 | 96.1 | 243.7 | 211.0 | 312.2 |

| 2012 | [138] | 2017 | 97.7 | 66.1 | 63.1 | 111.4 | 96.0 | N/A | 152.4 | 242.0 |

| 2013 | [139] | 2018 | 100.1 | 67.1 | 65.6 | 108.4 | 86.6 | 221.5 | 144.3 | 261.5 |

| 2014 | [140] | 2019 | 95.6 | 66.3 | 64.4 | 96.1 | 80.3 | 204.1 | 130.0 | 243.1 |

| 2015 | [135] | 2020 | 95.1 | 75.2 | 72.6 | 95.2 | 73.6 | 196.9 | 125.3 | 239.7 |

| 2016 | [141] | 2022 | NB | 58.1 | 57.2 | 102.8 | 64.5 | 158.1 | 84.7 | 235.9 |

| 2017 | [142] | 2022 | NB | 58.6 | 53.8 | 96.2 | 55.8 | NB | 73.7 | NB |

| 2018 | [143] | 2022 | NB | 48.3 | 48.1 | 90.1 | 48.0 | 124.6 | 59.1 | NB |

| 2019 | [143] | 2023 | NB | 40.8 | 40.2 | NB | 42.8 | 117.9 | 48.8 | NB |

| 2020 | [144] | 2025 | NB | 36.61 | 36.61 | NB | 34.10 | 115.04 | 32.80 | NA |

| Nominal change 2010–2020 | NB | −56% | −54% | NB | −77% | -40% | −92% | NB | ||

Note: Projected LCOE are adjusted for inflation and calculated on constant dollars based on two years prior to the release year of the estimate.

Estimates given without any subsidies. Transmission cost for non-dispatchable sources are on average much higher. NB = "Not built" (No capacity additions are expected.)

See also

[edit]- Electricity pricing

- Life-cycle greenhouse gas emissions of energy sources

- Distributed generation

- Economics of nuclear power plants

- Demand response

- Variable renewable energy

- Levelized cost of water

- National Grid Reserve Service

- Nuclear power in France

- List of thermal power station failures

- Calculating the cost of the UK Transmission network: Estimating cost per kWh of transmission

- List of countries by renewable electricity production

- List of U.S. states by renewable electricity production

- Environmental impact of electricity generation

- Grid parity

Further reading

[edit]- Machol, Ben; Rizk, Sarah (February 2013). "Economic value of U.S. fossil fuel electricity health impacts". Environment International. 52: 75–80. doi:10.1016/j.envint.2012.03.003. PMID 23246069.

- Lazard's Levelized Cost of Energy Analysis – Version 14.0 Archived 28 January 2021 at the Wayback Machine (Oct. 2020)

Notes

[edit]References

[edit]- ^ "WG III contribution to the Sixth Assessment Report" (PDF). Archived from the original (PDF) on 4 April 2022. Retrieved 4 April 2022.

- ^ "Working Group III Report" (PDF). Archived from the original (PDF) on 4 April 2022. Retrieved 4 April 2022.

- ^ Chrobak, Ula (28 January 2021). "Solar power got cheap. So why aren't we using it more?". Popular Science. Infographics by Sara Chodosh. Archived from the original on 29 January 2021. Chodosh's graphic is derived from data in "Lazard's Levelized Cost of Energy Version 14.0" (PDF). Lazard.com. Lazard. 19 October 2020. Archived (PDF) from the original on 28 January 2021.

- ^ "Lazard LCOE Levelized Cost Of Energy+" (PDF). Lazard. June 2024. p. 16. Archived (PDF) from the original on 28 August 2024.

- ^ "Renewable Power Costs in 2022". IRENA.org. International Renewable Energy Agency. August 2023. Archived from the original on 29 August 2023.

- ^ "Majority of New Renewables Undercut Cheapest Fossil Fuel on Cost". IRENA.org. International Renewable Energy Agency. 22 June 2021. Archived from the original on 22 June 2021. ● Infographic (with numerical data) and archive thereof

- ^ Renewable Energy Generation Costs in 2022 (PDF). International Renewable Energy Agency (IRENA). 2023. p. 57. ISBN 978-92-9260-544-5. Archived (PDF) from the original on 30 August 2023. Fig. 1.11

- ^ "Why did renewables become so cheap so fast?". Our World in Data. Retrieved 4 June 2022.

- ^ Nuclear Energy Agency/International Energy Agency/Organization for Economic Cooperation and Development Projected Costs of Generating Electricity (2005 Update) Archived 12 September 2016 at the Wayback Machine

- ^ Schmidt, Oliver; Melchior, Sylvain; Hawkes, Adam; Staffell, Iain (January 2019). "Projecting the Future Levelized Cost of Electricity Storage Technologies". Joule. 3 (1): 81–100. doi:10.1016/j.joule.2018.12.008. hdl:10044/1/75632.

- ^ a b Hittinger, Eric S.; Azevedo, Inês M. L. (28 January 2015). "Bulk Energy Storage Increases United States Electricity System Emissions". Environmental Science & Technology. 49 (5): 3203–3210. Bibcode:2015EnST...49.3203H. doi:10.1021/es505027p. PMID 25629631.

- ^ US Energy Information Administration (July 2013). "Assessing the Economic Value of New Utility-Scale Electricity Generation Projects" (PDF). p. 1.

Using LACE along with LCOE and LCOS provides a more intuitive indication of economic competitiveness for each technology than either metric separately when several technologies are available to meet load.

- ^ US Energy Information Administration, Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2014, April 2014.

- ^ EIA 2021 Levelized Costs of New Generation Resources in the Annual Energy Outlook 2021

- ^ Veronese, Elisa; Manzolini, Giampaolo; Moser, David (May 2021). "Improving the traditional levelized cost of electricity approach by including the integration costs in the techno‐economic evaluation of future photovoltaic plants". International Journal of Energy Research. 45 (6): 9252–9269. doi:10.1002/er.6456. hdl:11311/1203655. S2CID 234043064.

- ^ a b c "Renewable energy has hidden costs". The Economist. ISSN 0013-0613. Retrieved 21 September 2023.

- ^ Savcenko, Kira; Perez, Mario (21 December 2021). "Renewable capture prices: why they are crucial for energy transition". www.spglobal.com. Retrieved 21 September 2023.

- ^ Synertics. "Understanding Capture Prices". www.synertics.io. Retrieved 21 September 2023.

- ^ a b "Power surge: the value of investing in renewables - Risk.net". www.risk.net. 4 September 2020. Retrieved 21 September 2023.

- ^ A Review of Electricity Unit Cost Estimates Working Paper, December 2006 – Updated May 2007 "A Review of Electricity Unit Cost Estimates" (PDF). Archived from the original (PDF) on 8 January 2010. Retrieved 6 October 2009.

- ^ "Cost of wind, nuclear and gas powered generation in the UK". Claverton-energy.com. Retrieved 4 September 2012.

- ^ "David Millborrows paper on wind costs". Claverton-energy.com. Retrieved 4 September 2012.

- ^ "Cost and Performance Characteristics of New Generating Technologies" (PDF). Annual Energy Outlook 2022. U.S. Energy Information Administration. March 2022.

- ^ a b c "Electricity Technologies and Data Overview". US National Renewable Energy Laboratory. 2022.

- ^ "Olkiluoto 3: Finnlands EPR geht ans Netz". 9 March 2022.

- ^ "Final and Total Capital Costs of the Darlington Nuclear Generating Station" Archived 22 April 2012 at the Wayback Machine, Ontario Power Generation, 27 April 2004.

- ^ "Capacity factor – it's a measure of reliability".

- ^ World Nuclear Performance Report 2021 (Report). World Nuclear Association. September 2021. Report No. 2021/003.

- ^ "Explainer: Base Load and Peaking Power". 5 July 2012.

- ^ "Deutschland geht offshore: EWE, E.ON und Vattenfall errichten erste Windkraftanlage für alpha ventus" [Germany goes offshore: EWE, E.ON and Vattenfall build the first wind turbine for alpha ventus] (PDF) (Press release) (in German). alpha ventus. 15 July 2009.

- ^ "Offshore-Windpark alpha ventus produziert 2012 deutlich über dem Soll".

- ^ David L. Battye; Peter J. Ashman. Radiation associated with Hot Rock geothermal power (PDF). Australian Geothermal Energy Conference 2009.

- ^ "Þeistareykir geothermal station in operation". 18 November 2017.

- ^ "Siemens Annual Review 2006" (PDF). p. 2. Archived from the original (PDF) on 22 January 2017.

- ^ Vitzthum, Thomas (7 March 2013). "Energiewende: Stadtwerke fordern Gaskraftwerk-Abschaltung". Die Welt.

- ^ Martinez, A.; Iglesias, G. (February 2022). "Mapping of the levelised cost of energy for floating offshore wind in the European Atlantic". Renewable and Sustainable Energy Reviews. 154: 111889. doi:10.1016/j.rser.2021.111889. S2CID 244089510.

- ^ "Solarpark Lieberose in Zahlen". www.solarpark-lieberose.de. Archived from the original on 8 January 2014. Retrieved 27 April 2022.

- ^ "Größtes Solarkraftwerk in Deutschland eröffnet [5274]". 22 September 2018.

- ^ "Juwi verkauft Solarpark Lieberose". 30 March 2010.

- ^ "Bhadla Solar Park, Jodhpur District, Rajasthan, India".

- ^ Darci Pauser; Kaira Fuente; Mamadou Djerma. "Sustainable Rural Electrification" (PDF). GSDR 2015 Brief.

- ^ Schwartzman, David; Schwartzman, Peter (August 2013). "A Rapid Solar Transition is not only Possible, it is Imperative!". African Journal of Science, Technology, Innovation and Development. 5 (4): 297–302. doi:10.1080/20421338.2013.809260. S2CID 129118869.

- ^ "Why Refuel a Nuclear Reactor Now?". April 2020.

- ^ "Reactor Refueling". Nuclear Power.

- ^ "Nuclear Power Economics | Nuclear Energy Costs - World Nuclear Association".

- ^ "Benchmarking Nuclear Plant Operating Costs". November 2009.

- ^ "Nuclear Power Economic Costs".

- ^ "Der Strombedarf steigt, doch alte Windräder werden abmontiert".

- ^ "Schwarz-Gelb setzt auf Milliarden der AKW-Betreiber". Der Tagesspiegel Online. 29 September 2009.

- ^ ""Sollten Kernkraftwerke weiter betreiben"".

- ^ Frondel, Manuel. "Atomkraftwerke: Staat soll Laufzeiten versteigern statt verschenken". Faz.net.

- ^ "(Xenon-135) Response to Reactor Power Changes". Nuclear-Power.net. Retrieved 8 August 2019.

- ^ "Molten Salt Reactors". World Nuclear Association. December 2018. Retrieved 8 August 2019.

MSRs have large negative temperature and void coefficients of reactivity, and are designed to shut down due to expansion of the fuel salt as temperature increases beyond design limits. . . . The MSR thus has a significant load-following capability where reduced heat abstraction through the boiler tubes leads to increased coolant temperature, or greater heat removal reduces coolant temperature and increases reactivity.

- ^ Joskow, Paul L (1 May 2011). "Comparing the Costs of Intermittent and Dispatchable Electricity Generating Technologies" (PDF). American Economic Review. 101 (3): 238–241. doi:10.1257/aer.101.3.238.

- ^ Branker, K.; Pathak, M.J.M.; Pearce, J.M. (2011). "A Review of Solar Photovoltaic Levelized Cost of Electricity". Renewable and Sustainable Energy Reviews. 15 (9): 4470–4482. doi:10.1016/j.rser.2011.07.104. hdl:1974/6879. S2CID 73523633. Open access

- ^ a b c d Bronski, Peter (29 May 2014). "You Down With LCOE? Maybe You, But Not Me:Leaving behind the limitations of levelized cost of energy for a better energy metric". RMI Outlet. Rocky Mountain Institute (RMI). Archived from the original on 28 October 2016. Retrieved 28 October 2016.

Desirable shifts in how we as a nation and as individual consumers—whether a residential home or commercial real estate property—manage, produce, and consume electricity can actually make LCOE numbers look worse, not better. This is particularly true when considering the influence of energy efficiency...If you're planning a new, big central power plant, you want to get the best value (i.e., lowest LCOE) possible. For the cost of any given power-generating asset, that comes through maximizing the number of kWh it cranks out over its economic lifetime, which runs exactly counter to the highly cost-effective energy efficiency that has been a driving force behind the country's flat and even declining electricity demand. On the flip side, planning new big, central power plants without taking continued energy efficiency gains (of which there's no shortage of opportunity—the February 2014 UNEP Finance Initiative report Commercial Real Estate: Unlocking the energy efficiency retrofit investment opportunity identified a $231–$300 billion annual market by 2020) into account risks overestimating the number of kWh we'd need from them and thus lowballing their LCOE... If I'm a homeowner or business considering purchasing rooftop solar outright, do I care more about the per-unit value (LCOE) or my total out of pocket (lifetime system cost)?...The per-unit value is less important than the thing considered as a whole...LCOE, for example, fails to take into account the time of day during which an asset can produce power, where it can be installed on the grid, and its carbon intensity, among many other variables. That's why, in addition to [levelized avoided cost of energy (LACE)], utilities and other electricity system stakeholders...have used benefit/cost calculations and/or an asset's capacity value or contribution to peak on a system or circuit level.

- ^ "U.S. electricity consumption 2020". Statista. Retrieved 23 February 2022.

- ^ "Energy Efficiency 2019 – Analysis". IEA. Retrieved 23 February 2022.

- ^ "Electricity – World Energy Outlook 2019 – Analysis". IEA. Retrieved 23 February 2022.

- ^ D'Agostino, Delia; Parker, Danny; Melià, Paco; Dotelli, Giovanni (January 2022). "Optimizing photovoltaic electric generation and roof insulation in existing residential buildings". Energy and Buildings. 255: 111652. doi:10.1016/j.enbuild.2021.111652. hdl:11311/1197905. S2CID 243838932.

- ^ a b "Subsidies and costs of EU energy. Project number: DESNL14583" Pages: 52. EcoFys, 10 October 2014. Accessed: 20 October 2014. Size: 70 pages in 2MB.

- ^ "Solar panel warranty explained". CLEAN ENERGY REVIEWS. Retrieved 19 March 2022.

- ^ Atasu, Atalay; Duran, Serasu; Wassenhove, Luk N. Van (18 June 2021). "The Dark Side of Solar Power". Harvard Business Review.

- ^ "Preliminary Environmental and Financial Viability Analysis of Circular Economy Scenarios for Satisfying PV System Service Lifetime" (PDF). 2021.

- ^ "New research reveals the real costs of electricity in Europe" (PDF). Archived from the original (PDF) on 24 September 2015. Retrieved 10 May 2019.

- ^ ExternE-Pol, External costs of current and advanced electricity systems, associated with emissions from the operation of power plants and with the rest of the energy chain, final technical report. See figure 9, 9b and figure 11

- ^ "Health Indicators of sustainable energy" (PDF). World Health Organization. 2021.

.... electric power generation based on the inefficient combustion of coal and diesel fuel [causes] air pollution and climate change emissions.

- ^ Kushta, Jonilda; Paisi, Niki; Van Der Gon, Hugo Denier; Lelieveld, Jos (1 April 2021). "Disease burden and excess mortality from coal-fired power plant emissions in Europe". Environmental Research Letters. 16 (4): 045010. Bibcode:2021ERL....16d5010K. doi:10.1088/1748-9326/abecff. S2CID 233580803.

- ^ "Carbon pricing – the one thing economists agree on - KPMG United Kingdom". KPMG. 9 November 2020. Archived from the original on 26 September 2021. Retrieved 26 September 2021.

- ^ Viktor Wesselak, Thomas Schabbach, Thomas Link, Joachim Fischer: Regenerative Energietechnik. Springer 2013, ISBN 978-3-642-24165-9, p. 27.

- ^ Publications: Vienna Convention on Civil Liability for Nuclear Damage. International Atomic Energy Agency.

- ^ Nuclear Power's Role in Generating Electricity Congressional Budget Office, May 2008.

- ^ Availability of Dam Insurance Archived 8 January 2016 at the Wayback Machine 1999

- ^ "What impact could a CBAM have on energy intensive sectors?". Committees.parliament.uk. Retrieved 22 February 2022.

- ^ "Brexit decision left UK firms paying 10% more than EU rivals for emissions". the Guardian. 9 January 2022. Retrieved 6 February 2022.

- ^ Taylor, Kira (31 January 2022). "Europe's carbon border levy could pose another post-Brexit challenge for Ireland". Euractiv.com. Retrieved 6 February 2022.

- ^ Smallwood, K. Shawn (March 2013). "Comparing bird and bat fatality-rate estimates among North American wind-energy projects". Wildlife Society Bulletin. 37 (1): 19–33. doi:10.1002/wsb.260.

- ^ "How Many Birds Are Killed by Wind Turbines?". American Bird Conservancy. 26 January 2021. Retrieved 5 March 2022.

- ^ "PolitiFact - Solar farms kill thousands of birds, but not as many as fossil fuel plants". Politifact.com. Retrieved 6 February 2022.

- ^ "New research shows proposed coal expansion will cost major cities USD 877 billion, cause quarter-of-a-million premature deaths, jeopardise climate goals". C40 Cities. Retrieved 6 February 2022.

- ^ a b "Annex III: Technology-specific cost and performance parameters. In: Climate Change 2014: Mitigation of Climate Change" (PDF). Cambridge University Press. p. 1333.

- ^ Renewable Power Generation Costs in 2019. Abu Dhabi: International Renewable Energy Agency (IRENA). June 2020. ISBN 978-92-9260-244-4. Retrieved 6 June 2020.

- ^ a b c "LCOE Lazard" (PDF). 1 April 2023.

Based on the then-estimated costs of the Vogtle Plant and US-focused

- ^ a b "Low-carbon generation is becoming cost competitive, NEA and IEA say in new report". Nuclear Energy Agency (NEA). 9 December 2020. Retrieved 23 June 2021.

- ^ a b c d "BNEF Executive Factbook" (PDF). 2 March 2021. Retrieved 3 March 2021.

- ^ Idel, Robert (15 November 2022). "Levelized Full System Costs of Electricity". Energy. 259: 124905. doi:10.1016/j.energy.2022.124905. ISSN 0360-5442.

- ^ "BofA: The nuclear necessity". AdvisorAnalyst.com. Retrieved 18 January 2024.

- ^ "Basic Information About NO₂". United States Environmental Protection Agency. 6 July 2016. Retrieved 23 February 2022.

- ^ "Levelised Cost of Electricity Calculator – Analysis". IEA. Retrieved 29 October 2021.

- ^ "Projected Costs of Generating Electricity 2020 – Analysis". IEA. Retrieved 29 October 2021.

- ^ "Levelized Cost of Energy and Levelized Cost of Storage 2020". 19 October 2020. Archived from the original on 20 February 2021. Retrieved 24 October 2020.

- ^ "Scale-up of Solar and Wind Puts Existing Coal, Gas at Risk". 28 April 2020. Retrieved 31 May 2020.

- ^ Parkinson, Giles (28 April 2020). "Solar, wind and battery storage now cheapest energy options just about everywhere". Reneweconomy.com.au. Retrieved 22 February 2022.

- ^ Haegel, Nancy M.; et al. (2017). "Terawatt-scale photovoltaics: Trajectories and challenges". Science (in German). 356 (6334): 141–143. Bibcode:2017Sci...356..141H. doi:10.1126/science.aal1288. hdl:10945/57762. OSTI 1352502. PMID 28408563. S2CID 206654326.

- ^ Panos Konstantin, Praxishandbuch Energiewirtschaft. Energieumwandlung, -transport und -beschaffung im liberalisierten Markt. Berlin – Heidelberg 2009, pp. 294, 302, 322, 340.

- ^ David Millborrow, Wind edges forward in cost-per-watt battle. In: Wind Power Monthly, Jan. 2011, zit. nach: Alois Schaffarczyk Technische Rahmenbedingungen. In: Jörg v. Böttcher (Hrsg.), Handbuch Windenergie. Onshore-Projekte: Realisierung, Finanzierung, Recht und Technik, München 2012, S. 166.

- ^ Fraunhofer ISE: Studie Stromgestehungskosten Erneuerbare Energien Mai 2012[permanent dead link].

- ^ Fraunhofer ISE: Studie Stromgestehungskosten Erneuerbare Energien November 2013.

- ^ Studie Levelised Cost of Electricity 2015 (Nicht mehr online verfügbar), archiviert vom Original 4 February 2022, retrieved 13 October 2017, Autor: VGB PowerTech

- ^ Fraunhofer ISE: Studie Stromgestehungskosten Erneuerbare Energien März 2018. Retrieved 21 March 2018.

- ^ Fraunhofer ISE: Studie Stromgestehungskosten Erneuerbare Energien Juni 2021. Retrieved 2 January 2022.

- ^ Karin Finkenzeller (6 December 2012). "Die Franzosen zweifeln an der Atomkraft" [The French doubt nuclear power]. Zeit Online (in German). Retrieved 12 December 2012.

- ^ "E.ON und RWE kippen AKW-Pläne in Großbritannien" [E.ON and RWE overturn nuclear power plant plans in Great Britain]. Reuters Deutschland (in German). 29 March 2012. Archived from the original on 3 January 2014. Retrieved 30 March 2012.

- ^ a b c d e f Electricity Generation Costs (PDF) (Report). UK: Department of Energy & Climate Change. 19 December 2013. p. 18. Retrieved 3 June 2014.

- ^ Knud Rehfeldt; Anna Kathrin Wallasch; Silke Luers, eds. (November 2013). Kostensituation der Windenergie an Land in Deutschland [Cost situation of onshore wind energy in Germany] (PDF) (Report) (in German). Deutschen Windguard. SP13007A1. Archived from the original (PDF) on 13 November 2013. Retrieved 8 September 2022.

- ^ "BEE: Solarstrom kostet nur noch minimal mehr als Strom aus Gas- und Atomkraftwerken; Photovoltaik-Folgekosten sehr gering" [BEE: Solar power only costs slightly more than power from gas and nuclear power plants; Photovoltaic follow-up costs are very low]. SolarServer (in German). 14 October 2014. Archived from the original on 16 October 2014. Retrieved 8 September 2022.

- ^ Umrechnung mit Wechselkurs vom 8. September 2022 und UK-Verbraucherpreisindex seit 2012.

- ^ "Electricity Market Reform – Delivery Plan" (PDF). Department of Energy and Climate Change. December 2013. Retrieved 4 May 2014.

- ^ Carsten Volkery: Kooperation mit China: Großbritannien baut erstes Atomkraftwerk seit Jahrzehnten, In: Spiegel Online 21 October 2013.

- ^ gov.uk: Hinkley Point C Contracts for the Hinkley Point C, veröffentlicht 29 September 2016. Retrieved 1 February 2022

- ^ "Ausschreibung Windanlagen auf See". Bundesnetzagentur. Retrieved 5 September 2021.

- ^ Jillian Ambrose (20 September 2019), "New windfarms will not cost billpayers after subsidies hit record low", The Guardian (in German), ISSN 0261-3077, retrieved 3 October 2019

- ^ Mike Parr says (31 July 2019). "Portugal's solar energy auction breaks world record". www.euractiv.com. Retrieved 3 October 2019.

- ^ a b "What is the future of nuclear power in the UK?". The Week UK. Retrieved 23 February 2022.

- ^ "Climate change: Can the UK afford its net zero policies?". BBC News. 23 February 2022. Retrieved 23 February 2022.

- ^ "Contracts for Difference auctions to be held annually in 'major step forwards' for net zero transition". Current. 9 February 2022. Retrieved 23 February 2022.

- ^ "CfD costs to be paid back to electricity suppliers as high wholesale prices continue". Current. 13 January 2022. Retrieved 23 February 2022.

- ^ "UK electricity prices quadrupled in 2021 and fossil gas is to blame". Ember. 14 January 2022. Retrieved 23 February 2022.

- ^ McNally, Phil (18 February 2022). "An Efficient Energy Transition: Lessons From the UK's Offshore Wind Rollout". Tony Blair Institute.

- ^ "New Britain-Norway power link makes debut as energy prices soar". Reuters. 1 October 2021. Retrieved 23 February 2022.

- ^ a b "Coûts de production des ENR" (PDF). ADEME. 22 November 2017. Archived from the original (PDF) on 26 February 2019. Retrieved 10 May 2019.

- ^ "One simple chart shows why an energy revolution is coming — and who is likely to come out on top". Business Insider France (in French). 8 May 2018. Retrieved 17 October 2018.

- ^ "Study: Levelized Cost of Electricity - Renewable Energy Technologies - Fraunhofer ISE". Fraunhofer Institute for Solar Energy Systems ISE. Retrieved 8 September 2022.

- ^ "Study: Levelized Cost of Electricity - Renewable Energy Technologies - Fraunhofer ISE". Fraunhofer Institute for Solar Energy Systems ISE. Retrieved 7 September 2022.

- ^ Ahmadi, Esmaeil; McLellan, Benjamin; Ogata, Seiichi; Mohammadi-Ivatloo, Behnam; Tezuka, Tetsuo (2020). "An Integrated Planning Framework for Sustainable Water and Energy Supply". Sustainability. 12 (10): 4295. doi:10.3390/su12104295. hdl:2433/259701.

- ^ a b Olğun, Kinstellar-Şeyma (February 2021). "New Turkish-Lira tariff scheme for renewable energy projects in Turkey | Lexology". Lexology.com. Retrieved 3 February 2021.

- ^ "Amendments In The Law On Utilization Of Renewable Energy Sources For The Purpose Of Generating Electrical Energy - Energy and Natural Resources - Turkey". Mondaq.com. Retrieved 21 December 2020.

- ^ Energy Deals 2019 (Report). PricewaterhouseCoopers. February 2020. Archived from the original on 12 January 2021. Retrieved 4 February 2021.

- ^ "2010 Annual Report on Energy (Japan's "Energy White Paper 2010") (outline)" (PDF). 28 May 2021. Archived (PDF) from the original on 21 September 2016. Retrieved 1 October 2021.

- ^ Johnston, Eric, "Son's quest for sun, wind has nuclear interests wary", Japan Times, 12 July 2011, p. 3.

- ^ Bird, Winifred, "Powering Japan's future", Japan Times, 24 July 2011, p. 7.

- ^ Johnston, Eric, "Current nuclear debate to set nation's course for decades", Japan Times, 23 September 2011, p. 1. [dead link]

- ^ "Solar Power Generation Costs in Japan" (PDF). Renewable Energy Institute. Retrieved 30 June 2020.

- ^ "U.S. Energy Information Administration (EIA) – Source". Retrieved 25 November 2016.

- ^ a b US Energy Information Administration, Levelized cost and levelized avoided cost of new generation resources in the Annual Energy Outlook 2015, 14 April 2015

- ^ US Energy Information Administration, 2016 Levelized cost of new generation resources in the Annual Energy Outlook 2010, 26 April 2010

- ^ US Energy Information Administration, Levelized cost of new generation resources in the Annual Energy Outlook 2011, 26 April 2011

- ^ US Energy Information Administration, Levelized cost of new generation resources in the Annual Energy Outlook 2012, 12 July 2012

- ^ US Energy Information Administration, Levelized cost of new generation resources in the Annual Energy Outlook 2013, 28 January 2013

- ^ US Energy Information Administration, Levelized cost and levelized avoided cost of new generation resources in the Annual Energy Outlook 2014, 17 April 2014

- ^ Levelized cost and levelized avoided cost of new generation resources, US Energy Information Administration, Annual Energy Audit 2016, 5 August 2016.

- ^ Levelized cost and levelized avoided cost of new generation resources, US Energy Information Administration, Annual Energy Outlook 2017, April 2017.

- ^ a b Levelized cost and levelized avoided cost of new generation resources, US Energy Information Administration, Annual Energy Outlook 2018, March 2018.

- ^ "Levelized Costs of New Generation Resources in the Annual Energy Outlook 2021" (PDF). Eia.gov. February 2021. Retrieved 22 February 2022.