State tax levels in the United States

| This article is part of a series on |

| Taxation in the United States |

|---|

|

| |

% of income

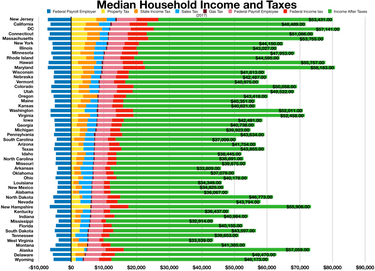

State tax levels indicate both the tax burden and the services a state can afford to provide residents.

States use a different combination of sales, income, excise taxes, and user fees. Some are levied directly from residents and others are levied indirectly. This table includes the per capita tax collected at the state level.

This table does not necessarily reflect the actual tax burdens borne directly by individual persons or businesses in a state. For example, the direct state tax burden on individuals in Alaska is far lower than the table would indicate. The state has no direct personal income tax and does not collect a sales tax at the state level, although it allows local governments to collect their own sales taxes. Alaska collects most of its revenue from corporate taxes on the oil and gas industry.

This table does not take into consideration the taxing and spending of local governments within states, which can vary widely, and sometimes disproportionately with state tax burdens.

State government tax collections (2015)

[edit]This data is collected by the United States Census Bureau for state governments during fiscal year 2015. These statistics include tax collections for state governments only; they do not include tax collections from local governments.[1] % represents the proportion of total taxes from that category and not the tax rate.

| Sales taxes[A] ($ thousands) | Income taxes[B] ($ thousands) | Property taxes[C] ($ thousands) | License taxes ($ thousands) | Other taxes[D] ($ thousands) | Total taxes ($ thousands) | Population[E] | Per capita ($) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| State | % | % | % | % | % | ||||||||||

| Alabama | 4936049 | 50.6% | 3870173 | 39.7% | 336825 | 3.5% | 493883 | 5.1% | 118509 | 1.2% | 9755439 | 4853875 | 2009.82 | ||

| Alaska | 255971 | 29.6% | 227852 | 26.4% | 127821 | 14.8% | 146846 | 17.0% | 105233 | 12.2% | 863723 | 737709 | 1170.82 | ||

| Arizona | 8246393 | 58.6% | 4451843 | 31.6% | 882643 | 6.3% | 458737 | 3.3% | 42484 | 0.3% | 14082100 | 6817565 | 2065.56 | ||

| Arkansas | 4410340 | 48.0% | 3140706 | 34.2% | 1088431 | 11.8% | 384306 | 4.2% | 166429 | 1.8% | 9190212 | 2977853 | 3086.19 | ||

| California | 52347262 | 34.6% | 86936733 | 57.5% | 2315507 | 1.5% | 9421978 | 6.2% | 151163 | 0.1% | 151172643 | 38993940 | 3876.82 | ||

| Colorado | 4788704 | 37.4% | 7048478 | 55.0% | 0 | 0.0% | 680767 | 5.3% | 292683 | 2.3% | 12810632 | 5448819 | 2351.08 | ||

| Connecticut | 6562147 | 40.4% | 8871756 | 54.7% | 0 | 0.0% | 452687 | 2.8% | 345368 | 2.1% | 16231958 | 3584730 | 4528.08 | ||

| Delaware | 498557 | 14.2% | 1540994 | 43.9% | 0 | 0.0% | 1389894 | 39.6% | 84471 | 2.4% | 3513916 | 944076 | 3722.07 | ||

| Florida | 30336315 | 81.5% | 2237500 | 6.0% | 70 | 0.0% | 2138834 | 5.7% | 2505040 | 6.7% | 37217759 | 20244914 | 1838.38 | ||

| Georgia | 7555865 | 38.3% | 10679060 | 54.1% | 862493 | 4.4% | 626088 | 3.2% | 224 | 0.0% | 19723730 | 10199398 | 1933.81 | ||

| Hawaii | 4082196 | 62.9% | 2060164 | 31.8% | 0 | 0.0% | 252431 | 3.9% | 90772 | 1.4% | 6485563 | 1425157 | 4550.77 | ||

| Idaho | 1940708 | 48.8% | 1695450 | 42.6% | 0 | 0.0% | 333144 | 8.4% | 6143 | 0.2% | 3975445 | 1652828 | 2405.24 | ||

| Illinois | 16102948 | 41.0% | 19968083 | 50.8% | 60959 | 0.2% | 2730407 | 7.0% | 420654 | 1.1% | 39283051 | 12839047 | 3059.65 | ||

| Indiana | 10591278 | 60.9% | 6136548 | 35.3% | 8834 | 0.1% | 656381 | 3.8% | 6609 | 0.0% | 17399650 | 6612768 | 2631.22 | ||

| Iowa | 4268628 | 46.5% | 3934855 | 42.8% | 1772 | 0.0% | 874778 | 9.5% | 109222 | 1.2% | 9189255 | 3121997 | 2943.39 | ||

| Kansas | 3977806 | 50.5% | 2721257 | 34.5% | 658758 | 8.4% | 378193 | 4.8% | 147946 | 1.9% | 7883960 | 2906721 | 2712.32 | ||

| Kentucky | 5450451 | 47.0% | 4821411 | 41.6% | 563435 | 4.9% | 487834 | 4.2% | 274852 | 2.4% | 11597983 | 4424611 | 2621.24 | ||

| Louisiana | 5307657 | 54.6% | 3236754 | 33.3% | 56658 | 0.6% | 386352 | 4.0% | 731334 | 7.5% | 9718755 | 4668960 | 2081.57 | ||

| Maine | 1999051 | 49.2% | 1702096 | 41.9% | 37028 | 0.9% | 268026 | 6.6% | 57874 | 1.4% | 4064075 | 1329453 | 3056.95 | ||

| Maryland | 8299002 | 41.8% | 9349733 | 47.1% | 738170 | 3.7% | 851466 | 4.3% | 611617 | 3.1% | 19849988 | 5994983 | 3311.10 | ||

| Massachusetts | 8274172 | 30.6% | 16719284 | 61.9% | 5311 | 0.0% | 1213135 | 4.5% | 800304 | 3.0% | 27012206 | 6784240 | 3981.61 | ||

| Michigan | 13124461 | 48.7% | 10010943 | 37.1% | 1963036 | 7.3% | 1563500 | 5.8% | 295397 | 1.1% | 26957337 | 9917715 | 2718.10 | ||

| Minnesota | 9953411 | 40.7% | 11846676 | 48.5% | 839487 | 3.4% | 1392055 | 5.7% | 407624 | 1.7% | 24439253 | 5482435 | 4457.74 | ||

| Mississippi | 4873512 | 61.6% | 2317985 | 29.3% | 25961 | 0.3% | 606432 | 7.7% | 82624 | 1.0% | 7906514 | 2989390 | 2644.86 | ||

| Missouri | 5084211 | 42.5% | 6281907 | 52.5% | 30265 | 0.3% | 547993 | 4.6% | 11767 | 0.1% | 11956143 | 6076204 | 1967.70 | ||

| Montana | 603200 | 21.2% | 1348517 | 47.4% | 268057 | 9.4% | 350769 | 12.3% | 272922 | 9.6% | 2843465 | 1032073 | 2755.10 | ||

| Nebraska | 2315830 | 45.5% | 2584059 | 50.8% | 119 | 0.0% | 172391 | 3.4% | 14360 | 0.3% | 5086759 | 1893765 | 2686.06 | ||

| Nevada | 6038768 | 80.2% | 0 | 0.0% | 242168 | 3.2% | 649333 | 8.6% | 602720 | 8.0% | 7532989 | 2883758 | 2612.21 | ||

| New Hampshire | 970102 | 39.0% | 672717 | 27.0% | 404579 | 16.3% | 322667 | 13.0% | 117672 | 4.7% | 2487737 | 1330111 | 1870.32 | ||

| New Jersey | 12951867 | 41.0% | 15829393 | 50.1% | 4547 | 0.0% | 1553255 | 4.9% | 1228592 | 3.9% | 31567654 | 8935421 | 3532.87 | ||

| New Mexico | 2995689 | 49.8% | 1631201 | 27.1% | 108803 | 1.8% | 272008 | 4.5% | 1001742 | 16.7% | 6009443 | 2080328 | 2888.70 | ||

| New York | 23969841 | 30.6% | 48797671 | 62.4% | 0 | 0.0% | 1764149 | 2.3% | 3711068 | 4.7% | 78242729 | 19747183 | 3962.22 | ||

| North Carolina | 10712738 | 42.7% | 12527873 | 50.0% | 0 | 0.0% | 1753433 | 7.0% | 67548 | 0.3% | 25061592 | 10035186 | 2497.37 | ||

| North Dakota | 1938816 | 33.8% | 722658 | 12.6% | 3505 | 0.1% | 225540 | 3.9% | 2849324 | 49.6% | 5739843 | 756835 | 7584.01 | ||

| Ohio | 17214405 | 60.8% | 8885559 | 31.4% | 0 | 0.0% | 2171231 | 7.7% | 25961 | 0.1% | 28297156 | 11605090 | 2438.34 | ||

| Oklahoma | 4136027 | 44.0% | 3640820 | 38.7% | 0 | 0.0% | 1055808 | 11.2% | 574738 | 6.1% | 9407393 | 3907414 | 2407.58 | ||

| Oregon | 1498647 | 14.2% | 7930842 | 75.0% | 20336 | 0.2% | 987018 | 9.3% | 138322 | 1.3% | 10575165 | 4024634 | 2627.61 | ||

| Pennsylvania | 18369805 | 50.9% | 13999109 | 38.8% | 41859 | 0.1% | 2222055 | 6.2% | 1477467 | 4.1% | 36110295 | 12791904 | 2822.90 | ||

| Rhode Island | 1620523 | 50.7% | 1391704 | 43.5% | 2480 | 0.1% | 120832 | 3.8% | 61134 | 1.9% | 3196673 | 1055607 | 3028.28 | ||

| South Carolina | 4891618 | 50.8% | 4119129 | 42.8% | 26394 | 0.3% | 524285 | 5.4% | 71605 | 0.7% | 9633031 | 4894834 | 1968.00 | ||

| South Dakota | 1372682 | 82.0% | 4334 | 0.3% | 0 | 0.0% | 288796 | 17.3% | 8296 | 0.5% | 1674108 | 857919 | 1951.36 | ||

| Tennessee | 9195880 | 72.4% | 1703169 | 13.4% | 0 | 0.0% | 1502770 | 11.8% | 295836 | 2.3% | 12697655 | 6595056 | 1925.33 | ||

| Texas | 47654182 | 86.5% | 0 | 0.0% | 0 | 0.0% | 3426885 | 6.2% | 4005371 | 7.3% | 55086438 | 27429639 | 2008.28 | ||

| Utah | 2766724 | 41.3% | 3526399 | 52.6% | 0 | 0.0% | 280021 | 4.2% | 130212 | 1.9% | 6703356 | 2990632 | 2241.45 | ||

| Vermont | 1026188 | 33.7% | 821953 | 27.0% | 1035611 | 34.0% | 111527 | 3.7% | 47873 | 1.6% | 3043152 | 626088 | 4860.58 | ||

| Virginia | 6495087 | 31.6% | 12721796 | 61.9% | 32712 | 0.2% | 829279 | 4.0% | 458011 | 2.2% | 20536885 | 8367587 | 2454.34 | ||

| Washington | 16241234 | 78.7% | 0 | 0.0% | 2018393 | 9.8% | 1396989 | 6.8% | 987838 | 4.8% | 20644454 | 7160290 | 2883.19 | ||

| West Virginia | 2619323 | 47.1% | 2121215 | 38.1% | 6678 | 0.1% | 138918 | 2.5% | 679850 | 12.2% | 5565984 | 1841053 | 3023.26 | ||

| Wisconsin | 7647097 | 44.9% | 8101659 | 47.6% | 165155 | 1.0% | 1026575 | 6.0% | 78540 | 0.5% | 17019026 | 5767891 | 2950.65 | ||

| Wyoming | 994850 | 42.2% | 0 | 0.0% | 318569 | 13.5% | 153768 | 6.5% | 889136 | 37.7% | 2356323 | 586555 | 4017.22 | ||

| Total | 431255544 | 47.1% | 387206745 | 42.2% | 17555153 | 1.9% | 52199149 | 5.7% | 28271459 | 3.1% | 916488050 | 320896618 | 2856.02 | ||

Notes

[edit]- ^ Includes alcohol, fuel, and tobacco taxes

- ^ Includes both personal and business income

- ^ Only includes taxes collected at the state level

- ^ Includes inheritance, gift, and severance taxes

- ^ As of July 1, 2015[2]

State government tax collections (2012)

[edit]This data is collected by the United States Census Bureau for state governments during fiscal year 2012. These statistics include tax collections for state governments only; they do not include tax collections from local governments.[3] % represents the proportion of total taxes from that category and not the tax rate.

| Sales taxes[A] ($ thousands) | Income taxes[B] ($ thousands) | Property taxes[C] ($ thousands) | License taxes ($ thousands) | Other taxes[D] ($ thousands) | Total taxes ($ thousands) | Population[E] | Per capita ($) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| State | % | % | % | % | % | ||||||||||

| Alabama | 4,626,357 | 51% | 3,430,690 | 38% | 321,530 | 4% | 517,676 | 6% | 153,041 | 2% | 9,049,294 | 4,822,023 | 1,876.66 | ||

| Alaska | 248,432 | 4% | 663,144 | 9% | 215,407 | 3% | 135,055 | 2% | 5,787,360 | 82% | 7,049,398 | 731,449 | 9,637.58 | ||

| Arizona | 8,066,124 | 62% | 3,741,713 | 29% | 754,428 | 6% | 370,222 | 3% | 40,778 | 0% | 12,973,265 | 6,553,255 | 1,979.67 | ||

| Arkansas | 3,982,832 | 48% | 2,805,985 | 34% | 1,008,707 | 12% | 355,768 | 4% | 131,208 | 2% | 8,284,500 | 2,949,131 | 2,809.13 | ||

| California | 41,341,188 | 36% | 62,973,435 | 55% | 2,079,878 | 2% | 8,658,041 | 8% | 37,112 | 0% | 115,089,654 | 38,041,430 | 3,025.38 | ||

| Colorado | 4,090,645 | 40% | 5,367,851 | 52% | X | X | 616,752 | 6% | 175,380 | 2% | 10,250,628 | 5,187,582 | 1,975.99 | ||

| Connecticut | 6,678,117 | 43% | 7,996,509 | 52% | X | X | 416,396 | 3% | 309,996 | 2% | 15,401,018 | 3,590,347 | 4,289.56 | ||

| Delaware | 491,044 | 15% | 1,455,159 | 43% | X | X | 1,230,384 | 37% | 170,365 | 5% | 3,346,952 | 917,092 | 3,649.53 | ||

| Florida | 27,267,196 | 83% | 2,003,490 | 6% | 140 | 0% | 2,205,376 | 7% | 1,520,810 | 5% | 32,997,012 | 19,317,568 | 1,708.13 | ||

| Georgia | 7,253,554 | 44% | 8,733,047 | 53% | 68,951 | 0% | 505,618 | 3% | 15,733 | 0% | 16,576,903 | 9,919,945 | 1,671.07 | ||

| Hawaii | 3,581,652 | 65% | 1,621,002 | 29% | X | X | 258,795 | 5% | 54,697 | 1% | 5,516,146 | 1,392,313 | 3,961.86 | ||

| Idaho | 1,664,615 | 49% | 1,401,924 | 42% | X | X | 299,443 | 9% | 8,322 | 0% | 3,374,304 | 1,595,728 | 2,114.59 | ||

| Illinois | 14,295,688 | 39% | 19,006,849 | 52% | 65,106 | 0% | 2,602,296 | 7% | 287,823 | 1% | 36,257,762 | 12,875,255 | 2,816.08 | ||

| Indiana | 9,172,715 | 58% | 5,724,366 | 36% | 0 | 0% | 629,260 | 4% | 178,166 | 1% | 15,704,507 | 6,537,334 | 2,402.28 | ||

| Iowa | 3,532,811 | 45% | 3,455,485 | 44% | X | X | 751,627 | 10% | 92,465 | 1% | 7,832,388 | 3,074,186 | 2,547.79 | ||

| Kansas | 3,685,595 | 50% | 3,209,321 | 43% | 74,413 | 1% | 315,411 | 4% | 133,601 | 2% | 7,418,341 | 2,885,905 | 2,570.54 | ||

| Kentucky | 5,034,577 | 48% | 4,087,239 | 39% | 529,567 | 5% | 463,793 | 4% | 390,618 | 4% | 10,505,794 | 4,380,415 | 2,398.36 | ||

| Louisiana | 4,888,854 | 54% | 2,764,995 | 31% | 50,937 | 1% | 402,212 | 4% | 887,055 | 10% | 8,994,053 | 4,601,893 | 1,954.42 | ||

| Maine | 1,748,815 | 46% | 1,674,044 | 44% | 38,360 | 1% | 252,404 | 7% | 63,507 | 2% | 3,777,130 | 1,329,192 | 2,841.67 | ||

| Maryland | 7,173,515 | 42% | 7,996,961 | 47% | 755,937 | 4% | 730,878 | 4% | 381,203 | 2% | 17,038,494 | 5,884,563 | 2,895.46 | ||

| Massachusetts | 7,319,030 | 32% | 13,935,232 | 61% | 4,441 | 0% | 899,682 | 4% | 647,259 | 3% | 22,805,644 | 6,646,144 | 3,431.41 | ||

| Michigan | 12,654,547 | 53% | 7,725,070 | 32% | 1,911,188 | 8% | 1,414,986 | 6% | 213,950 | 1% | 23,919,741 | 9,883,360 | 2,420.20 | ||

| Minnesota | 9,139,154 | 44% | 9,054,106 | 44% | 807,700 | 4% | 1,186,734 | 6% | 372,846 | 2% | 20,560,540 | 5,379,139 | 3,822.27 | ||

| Mississippi | 4,396,669 | 63% | 1,896,945 | 27% | 23,982 | 0% | 517,982 | 7% | 117,784 | 2% | 6,953,362 | 2,984,926 | 2,329.49 | ||

| Missouri | 4,764,940 | 44% | 5,433,367 | 50% | 29,409 | 0% | 563,570 | 5% | 10,766 | 0% | 10,802,052 | 6,021,988 | 1,793.77 | ||

| Montana | 544,733 | 22% | 1,032,541 | 42% | 257,189 | 10% | 315,571 | 13% | 309,290 | 13% | 2,459,324 | 1,005,141 | 2,446.75 | ||

| Nebraska | 2,059,913 | 48% | 2,072,640 | 48% | 78 | 0% | 183,035 | 4% | 17,091 | 0% | 4,332,757 | 1,855,525 | 2,335.06 | ||

| Nevada | 5,231,962 | 77% | 0 | 0% | 234,522 | 3% | 583,829 | 9% | 724,799 | 11% | 6,775,112 | 2,758,931 | 2,455.70 | ||

| New Hampshire | 875,037 | 40% | 602,866 | 27% | 380,682 | 17% | 265,555 | 12% | 84,061 | 4% | 2,208,201 | 1,320,718 | 1,671.97 | ||

| New Jersey | 12,009,552 | 44% | 13,057,551 | 48% | 5,650 | 0% | 1,425,441 | 5% | 957,981 | 3% | 27,456,175 | 8,864,590 | 3,097.29 | ||

| New Mexico | 2,653,449 | 52% | 1,431,515 | 28% | 60,183 | 1% | 180,259 | 4% | 767,736 | 15% | 5,093,142 | 2,085,538 | 2,442.12 | ||

| New York | 22,869,327 | 32% | 43,339,857 | 61% | X | X | 1,926,804 | 3% | 3,409,757 | 5% | 71,545,745 | 19,570,261 | 3,655.84 | ||

| North Carolina | 9,539,299 | 42% | 11,603,868 | 51% | X | X | 1,475,960 | 6% | 94,230 | 0% | 22,713,357 | 9,752,073 | 2,329.08 | ||

| North Dakota | 1,594,529 | 28% | 648,149 | 12% | 2,398 | 0% | 187,847 | 3% | 3,187,113 | 57% | 5,620,036 | 699,628 | 8,032.89 | ||

| Ohio | 13,119,734 | 51% | 9,147,103 | 35% | X | X | 3,580,483 | 14% | 76,704 | 0% | 25,924,024 | 11,544,225 | 2,245.63 | ||

| Oklahoma | 3,724,416 | 42% | 3,220,385 | 36% | X | X | 1,032,981 | 12% | 861,517 | 10% | 8,839,299 | 3,814,820 | 2,317.09 | ||

| Oregon | 1,398,998 | 16% | 6,258,923 | 72% | 15,710 | 0% | 903,132 | 10% | 122,863 | 1% | 8,699,626 | 3,899,353 | 2,231.04 | ||

| Pennsylvania | 17,151,633 | 52% | 11,939,487 | 36% | 38,452 | 0% | 2,646,493 | 8% | 1,173,852 | 4% | 32,949,917 | 12,763,536 | 2,581.57 | ||

| Rhode Island | 1,477,992 | 52% | 1,203,959 | 43% | 2,095 | 0% | 107,595 | 4% | 35,862 | 1% | 2,827,503 | 1,050,292 | 2,692.11 | ||

| South Carolina | 4,198,261 | 52% | 3,349,738 | 42% | 8,811 | 0% | 449,727 | 6% | 29,945 | 0% | 8,036,482 | 4,723,723 | 1,701.30 | ||

| South Dakota | 1,197,116 | 79% | 59,837 | 4% | X | X | 250,572 | 16% | 13,952 | 1% | 1,521,477 | 833,354 | 1,825.73 | ||

| Tennessee | 8,962,195 | 75% | 1,408,141 | 12% | X | X | 1,282,015 | 11% | 329,994 | 3% | 11,982,345 | 6,456,243 | 1,855.93 | ||

| Texas | 37,431,966 | 77% | 0 | 0% | X | X | 7,509,000 | 15% | 3,655,582 | 8% | 48,596,548 | 26,059,203 | 1,864.85 | ||

| Utah | 2,722,128 | 47% | 2,725,073 | 47% | X | X | 255,677 | 4% | 107,075 | 2% | 5,809,953 | 2,855,287 | 2,034.81 | ||

| Vermont | 968,303 | 35% | 695,029 | 25% | 948,749 | 34% | 101,161 | 4% | 44,128 | 2% | 2,757,370 | 626,011 | 4,404.67 | ||

| Virginia | 5,853,266 | 32% | 11,054,938 | 61% | 34,297 | 0% | 777,187 | 4% | 417,898 | 2% | 18,137,586 | 8,185,867 | 2,215.72 | ||

| Washington | 14,171,443 | 80% | 0 | 0% | 1,897,095 | 11% | 994,819 | 6% | 561,358 | 3% | 17,624,715 | 6,897,012 | 2,555.41 | ||

| West Virginia | 2,559,586 | 48% | 1,948,131 | 37% | 6,039 | 0% | 137,670 | 3% | 634,347 | 12% | 5,285,773 | 1,855,413 | 2,848.84 | ||

| Wisconsin | 7,008,022 | 44% | 7,696,502 | 48% | 155,571 | 1% | 1,077,742 | 7% | 57,498 | 0% | 15,995,335 | 5,726,398 | 2,793.26 | ||

| Wyoming | 1,120,203 | 44% | 0 | 0% | 316,734 | 12% | 140,045 | 5% | 974,009 | 38% | 2,550,991 | 576,412 | 4,425.64 | ||

| Total | 377,541,729 | 47% | 322,654,162 | 40% | 13,104,336 | 2% | 54,090,961 | 7% | 30,830,487 | 4% | 798,221,675 | 313,914,040 | 2,542.80 | ||

Notes

[edit]- ^ Includes alcohol, fuel, and tobacco taxes

- ^ Includes both personal and business income

- ^ Only includes taxes collected at the state level

- ^ Includes inheritance, gift, and severance taxes

- ^ As of July 1, 2012[4]

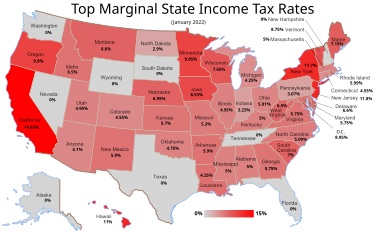

State individual income tax rates and brackets

[edit]| State | Single filer rates > Brackets | Married filing jointly rates > Brackets |

|---|---|---|

| Ala. | 2.00% > $0 | 2.00% > $0 |

| 4.00% > $500 | 4.00% > $1,000 | |

| 5.00% > $3,000 | 5.00% > $6,000 | |

| Alaska | none | none |

| Ariz. | 2.59% > $0 | 2.59% > $0 |

| 2.88% > $10,000 | 2.88% > $20,000 | |

| 3.36% > $25,000 | 3.36% > $50,000 | |

| 4.24% > $50,000 | 4.24% > $100,000 | |

| 4.54% > $150,000 | 4.54% > $300,000 | |

| Ark. | 0.90% > $0 | 0.90% > $0 |

| 2.50% > $4,299 | 2.50% > $4,299 | |

| 3.50% > $8,399 | 3.50% > $8,399 | |

| 4.50% > $12,599 | 4.50% > $12,599 | |

| 6.00% > $20,999 | 6.00% > $20,999 | |

| 6.90% > $35,099 | 6.90% > $35,099 | |

| Calif. | 1.00% > $0 | 1.00% > $0 |

| 2.00% > $7,850 | 2.00% > $15,700 | |

| 4.00% > $18,610 | 4.00% > $37,220 | |

| 6.00% > $29,372 | 6.00% > $58,744 | |

| 8.00% > $40,773 | 8.00% > $81,546 | |

| 9.30% > $51,530 | 9.30% > $103,060 | |

| 10.30% > $263,222 | 10.30% > $526,444 | |

| 11.30% > $315,866 | 11.30% > $631,732 | |

| 12.30% > $526,443 | 12.30% > $1,000,000 | |

| 13.30% > $1,000,000 | 13.30% > $1,052,886 | |

| Colo. | 4.63% of federal | 4.63% of federal |

| Conn. | 3.00% > $0 | 3.00% > $0 |

| 5.00% > $10,000 | 5.00% > $20,000 | |

| 5.50% > $50,000 | 5.50% > $100,000 | |

| 6.00% > $100,000 | 6.00% > $200,000 | |

| 6.50% > $200,000 | 6.50% > $400,000 | |

| 6.90% > $250,000 | 6.90% > $500,000 | |

| 6.99% > $500,000 | 6.99% > $1,000,000 | |

| Del. | 2.20% > $2,000 | 2.20% > $2,000 |

| 3.90% > $5,000 | 3.90% > $5,000 | |

| 4.80% > $10,000 | 4.80% > $10,000 | |

| 5.20% > $20,000 | 5.20% > $20,000 | |

| 5.55% > $25,000 | 5.55% > $25,000 | |

| 6.60% > $60,000 | 6.60% > $60,000 | |

| Fla. | none | none |

| Ga. | 1.00% > $0 | 1.00% > $0 |

| 2.00% > $750 | 2.00% > $1,000 | |

| 3.00% > $2,250 | 3.00% > $3,000 | |

| 4.00% > $3,750 | 4.00% > $5,000 | |

| 5.00% > $5,250 | 5.00% > $7,000 | |

| 6.00% > $7,000 | 6.00% > $10,000 | |

| Hawaii | 1.40% > $0 | 1.40% > $0 |

| 3.20% > $2,400 | 3.20% > $4,800 | |

| 5.50% > $4,800 | 5.50% > $9,600 | |

| 6.40% > $9,600 | 6.40% > $19,200 | |

| 6.80% > $14,400 | 6.80% > $28,800 | |

| 7.20% > $19,200 | 7.20% > $38,400 | |

| 7.60% > $24,000 | 7.60% > $48,000 | |

| 7.90% > $36,000 | 7.90% > $72,000 | |

| 8.25% > $48,000 | 8.25% > $96,000 | |

| Idaho | 1.60% > $0 | 1.60% > $0 |

| 3.60% > $1,452 | 3.60% > $2,904 | |

| 4.10% > $2,940 | 4.10% > $5,808 | |

| 5.10% > $4,356 | 5.10% > $8,712 | |

| 6.10% > $5,808 | 6.10% > $11,616 | |

| 7.10% > $7,260 | 7.10% > $14,520 | |

| 7.40% > $10,890 | 7.40% > $21,780 | |

| Ill. | 3.75% of federal | 3.75% of federal |

| Ind. | 3.3% of federal | 3.3% of federal |

| Iowa | 0.36% > $0 | 0.36% > $0 |

| 0.72% > $1,554 | 0.72% > $1,554 | |

| 2.43% > $3,108 | 2.43% > $3,108 | |

| 4.50% > $6,216 | 4.50% > $6,216 | |

| 6.12% > $13,896 | 6.12% > $13,896 | |

| 6.48% > $23,310 | 6.48% > $23,310 | |

| 6.80% > $31,080 | 6.80% > $31,080 | |

| 7.92% > $46,620 | 7.92% > $46,620 | |

| 8.98% > $69,930 | 8.98% > $69,930 | |

| Kans. | 2.70% > $0 | 2.70% > $0 |

| 4.60% > $15,000 | 4.60% > $30,000 | |

| Ky. | 2.00% > $0 | 2.00% > $0 |

| 3.00% > $3,000 | 3.00% > $3,000 | |

| 4.00% > $4,000 | 4.00% > $4,000 | |

| 5.00% > $5,000 | 5.00% > $5,000 | |

| 5.80% > $8,000 | 5.80% > $8,000 | |

| 6.00% > $75,000 | 6.00% > $75,000 | |

| La. | 2.00% > $0 | 2.00% > $0 |

| 4.00% > $12,500 | 4.00% > $25,000 | |

| 6.00% > $50,000 | 6.00% > $100,000 | |

| Maine | 5.80% > $0 | 5.80% > $0 |

| 6.75% > $21,049 | 6.75% > $42,099 | |

| 7.15% > $37,499 | 7.15% > $74,999 | |

| Md. | 2.00% > $0 | 2.00% > $0 |

| 3.00% > $1,000 | 3.00% > $1,000 | |

| 4.00% > $2,000 | 4.00% > $2,000 | |

| 4.75% > $3,000 | 4.75% > $3,000 | |

| 5.00% > $100,000 | 5.00% > $150,000 | |

| 5.25% > $125,000 | 5.25% > $175,000 | |

| 5.50% > $150,000 | 5.50% > $225,000 | |

| 5.75% > $250,000 | 5.75% > $300,000 | |

| Mass. | 5.10% > $0 | 5.10% > $0 |

| Mich. | 4.25% of federal AGI | 4.25% of federal AGI |

| Minn. | 5.35% > $0 | 5.35% > $0 |

| 7.05% > $25,180 | 7.05% > $36,820 | |

| 7.85% > $82,740 | 7.85% > $146,270 | |

| 9.85% > $155,650 | 9.85% > $259,420 | |

| Miss. | 3.00% > $0 | 3.00% > $0 |

| 4.00% > $5,000 | 4.00% > $5,000 | |

| 5.00% > $10,000 | 5.00% > $10,000 | |

| Mo. | 1.50% > $0 | 1.50% > $0 |

| 2.00% > $1,000 | 2.00% > $1,000 | |

| 2.50% > $2,000 | 2.50% > $2,000 | |

| 3.00% > $3,000 | 3.00% > $3,000 | |

| 3.50% > $4,000 | 3.50% > $4,000 | |

| 4.00% > $5,000 | 4.00% > $5,000 | |

| 4.50% > $6,000 | 4.50% > $6,000 | |

| 5.00% > $7,000 | 5.00% > $7,000 | |

| 5.50% > $8,000 | 5.50% > $8,000 | |

| 6.00% > $9,000 | 6.00% > $9,000 | |

| Mont. | 1.00% > $0 | 1.00% > $0 |

| 2.00% > $2,900 | 2.00% > $2,900 | |

| 3.00% > $5,100 | 3.00% > $5,100 | |

| 4.00% > $7,800 | 4.00% > $7,800 | |

| 5.00% > $10,500 | 5.00% > $10,500 | |

| 6.00% > $13,500 | 6.00% > $13,500 | |

| 6.90% > $17,400 | 6.90% > $17,400 | |

| Nebr. | 2.46% > $0 | 2.46% > $0 |

| 3.51% > $3,060 | 3.51% > $6,120 | |

| 5.01% > $18,370 | 5.01% > $36,730 | |

| 6.84% > $29,590 | 6.84% > $59,180 | |

| Nev. | none | none |

| N.H. | 5.00% > $0 Interest & dividends | 5.00% > $0 Interest & dividends |

| N.J. | 1.40% > $0 | 1.40% > $0 |

| 1.75% > $20,000 | 1.75% > $20,000 | |

| 3.50% > $35,000 | 2.45% > $50,000 | |

| 5.53% > $40,000 | 3.50% > $70,000 | |

| 6.37% > $75,000 | 5.53% > $80,000 | |

| 8.97% > $500,000 | 6.37% > $150,000 | |

| 8.97% > $500,000 | ||

| N.M. | 1.70% > $0 | 1.70% > $0 |

| 3.20% > $5,500 | 3.20% > $8,000 | |

| 4.70% > $11,000 | 4.70% > $16,000 | |

| 4.90% > $16,000 | 4.90% > $24,000 | |

| N.Y. | 4.00% > $0 | 4.00% > $0 |

| 4.50% > $8,450 | 4.50% > $17,050 | |

| 5.25% > $11,650 | 5.25% > $23,450 | |

| 5.90% > $13,850 | 5.90% > $27,750 | |

| 6.45% > $21,300 | 6.45% > $42,750 | |

| 6.65% > $80,150 | 6.65% > $160,500 | |

| 6.85% > $214,000 | 6.85% > $321,050 | |

| 8.82% > $1,070,350 | 8.82% > $2,140,900 | |

| N.C. | 5.75% > $0 | 5.75% > $0 |

| N.D. | 1.10% > $0 | 1.10% > $0 |

| 2.04% > $37,450 | 2.04% > $62,600 | |

| 2.27% > $90,750 | 2.27% > $151,200 | |

| 2.64% > $189,300 | 2.64% > $230,450 | |

| 2.90% > $411,500 | 2.90% > $411,500 | |

| Ohio | 0.50% > $0 | 0.50% > $0 |

| 0.99% > $5,200 | 0.99% > $5,200 | |

| 1.98% > $10,400 | 1.98% > $10,400 | |

| 2.48% > $15,650 | 2.48% > $15,650 | |

| 2.97% > $20,900 | 2.97% > $20,900 | |

| 3.47% > $41,700 | 3.47% > $41,700 | |

| 3.96% > $83,350 | 3.96% > $83,350 | |

| 4.60% > $104,250 | 4.60% > $104,250 | |

| 5.00% > $208,500 | 5.00% > $208,500 | |

| Okla. | 0.50% > $0 | 0.50% > $0 |

| 1.00% > $1,000 | 1.00% > $2,000 | |

| 2.00% > $2,500 | 2.00% > $5,000 | |

| 3.00% > $3,750 | 3.00% > $7,500 | |

| 4.00% > $4,900 | 4.00% > $9,800 | |

| 5.00% > $7,200 | 5.00% > $12,200 | |

| Ore. | 5.00% > $0 | 5.00% > $0 |

| 7.00% > $3,350 | 7.00% > $6,500 | |

| 9.00% > $8,400 | 9.00% > $16,300 | |

| 9.90% > $125,000 | 9.90% > $250,000 | |

| Pa. | 3.07% > $0 | 3.07% > $0 |

| R.I. | 3.75% > $0 | 3.75% > $0 |

| 4.75% > $60,850 | 4.75% > $60,850 | |

| 5.99% > $138,300 | 5.99% > $138,300 | |

| S.C. | 0.00% > $0 | 0.00% > $0 |

| 3.00% > $2,920 | 3.00% > $2,920 | |

| 4.00% > $5,840 | 4.00% > $5,840 | |

| 5.00% > $8,760 | 5.00% > $8,760 | |

| 6.00% > $11,680 | 6.00% > $11,680 | |

| 7.00% > $14,600 | 7.00% > $14,600 | |

| S.D. | none | none |

| Tenn. | 6.00% > $0 Interest & dividends | 6.00% > $0 Interest & dividends |

| Tex. | none | none |

| Utah | 5.00% > $0 | 5.00% > $0 |

| Vt. | 3.55% > $0 | 3.55% > $0 |

| 6.80% > $39,900 | 6.80% > $69,900 | |

| 7.80% > $93,400 | 7.80% > $160,450 | |

| 8.80% > $192,400 | 8.80% > $240,000 | |

| 8.95% > $415,600 | 8.95% > $421,900 | |

| Va. | 2.00% > $0 | 2.00% > $0 |

| 3.00% > $3,000 | 3.00% > $3,000 | |

| 5.00% > $5,000 | 5.00% > $5,000 | |

| 5.75% > $17,000 | 5.75% > $17,000 | |

| Wash. | none | none |

| W.Va. | 3.00% > $0 | 3.00% > $0 |

| 4.00% > $10,000 | 4.00% > $10,000 | |

| 4.50% > $25,000 | 4.50% > $25,000 | |

| 6.00% > $40,000 | 6.00% > $40,000 | |

| 6.50% > $60,000 | 6.50% > $60,000 | |

| Wis. | 4.00% > $0 | 4.00% > $0 |

| 5.84% > $11,150 | 5.84% > $14,820 | |

| 6.27% > $22,230 | 6.27% > $29,640 | |

| 7.65% > $244,750 | 7.65% > $326,330 | |

| Wyo. | none | none |

| D.C. | 4.00% > $0 | 4.00% > $0 |

| 6.00% > $10,000 | 6.00% > $10,000 | |

| 6.50% > $40,000 | 6.50% > $40,000 | |

| 8.50% > $60,000 | 8.50% > $60,000 | |

| 8.75% > $350,000 | 8.75% > $350,000 |

See also

[edit]State taxes:

Federal:

- Income tax in the United States

- Federal tax revenue by state

- Federal spending and taxation across states

General:

References

[edit]- ^ "State Government Tax Collections: 2015 2015 State Government Tax Collections". U.S. Census Bureau. Retrieved 2017-02-05.[permanent dead link]

- ^ "Table 1. Annual Estimates of the Resident Population for the United States, Regions, States, and Puerto Rico: April 1, 2010 to July 1, 2016 (NST-EST2016-01)". Census.gov. U.S. Census Bureau, Population Division. December 2016. Retrieved 3 February 2017.

- ^ "2012 Annual Survey of State Government Tax Collections". U.S. Census Bureau. Retrieved 2014-02-08.

- ^ "Annual Estimates of the Resident Population for the United States, Regions, States, and Puerto Rico: April 1, 2010 to July 1, 2012". U.S. Census Bureau. Retrieved 2014-02-08.

- ^ "State Individual Income Tax Rates and Brackets for 2016". 8 February 2016.